The Finite Frontier: How Much Gold is Left to Mine on Earth?

ntroduction

Gold has captivated humanity for millennia, serving as a symbol of wealth, a store of value, and a critical component in modern technology. But have you ever wondered how much gold is actually left to mine? As of 2025, we are facing a new reality: the world's supply of economically recoverable gold is finite and rapidly diminishing. This report, based on data from the World Gold Council and the U.S. Geological Survey, visualizes the stark reality of gold depletion and explores the implications for the future of this precious metal 1.

Visualizing the World's Gold: A Finite Resource

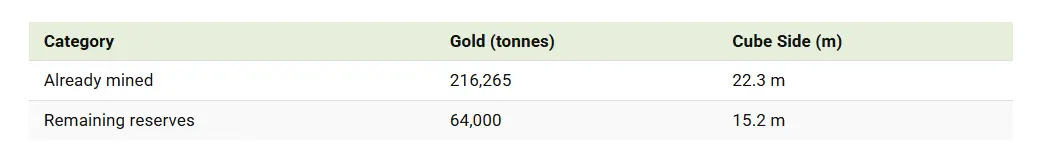

To comprehend the scale of gold mining, imagine all the gold ever extracted from the Earth. If melted down, it would form a single cube with sides of 22.3 meters—roughly the height of a four-story building. This cube would weigh approximately 216,265 tonnes. In contrast, the world's proven, economically recoverable gold reserves—the amount of gold still left in the ground that is feasible to mine—would form a much smaller cube with sides of just 15.2 meters, weighing 64,000 tonnes 1.

This means that nearly three-quarters of all the world's known gold has already been mined. The following table provides a clear comparison of what has been mined versus what remains:

The Modern Gold Rush and Its Aftermath

The vast majority of gold extraction has occurred in the modern era. In fact, two-thirds of all gold ever mined has been pulled from the ground since 1950, a testament to the technological advancements in mining and refining that defined the post-war period. However, this rapid extraction has come at a cost. Today, the rate of new gold discoveries is slowing, and the quality of remaining ore is declining, leading to rising mining costs 1.

Of the gold that has been mined, about 45% is held as jewelry, 22% as bars and coins for investment, and 17% by central banks as a strategic asset to hedge against inflation and geopolitical instability. The remainder is used in various technological applications, from electronics to aerospace components 1.

Economic Pressures and the Future of Gold

The increasing scarcity of gold is a key factor behind its enduring value. In 2025, gold prices surged by over 50% to reach an unprecedented $4,000 per ounce, driven by global economic uncertainty, a weaker U.S. dollar, and rising demand from both institutional and retail investors. This price rally has significant implications for the future of gold mining. As prices rise, deposits that were previously considered uneconomical to mine may become viable, incentivizing new exploration and the development of more advanced extraction technologies 1.

Furthermore, the focus of the gold industry is increasingly shifting towards sustainability and efficiency. Recycling existing gold and improving recovery technologies are becoming critical components of the supply chain, helping to bridge the gap between declining mine production and growing demand.

Conclusion

The era of easily accessible, high-grade gold deposits is drawing to a close. While the allure of gold remains as strong as ever, the future of its supply will be defined by the challenges of scarcity and the innovation required to overcome them. The world's remaining gold reserves are a finite frontier, and their careful management will be crucial in shaping the economic and geopolitical landscape of the 21st century.

SiniSa Dagary, www.sinisadagary.com