Beyond Bitcoin: A Visual Guide to Investing in the Entire Blockchain Ecosystem

Introduction

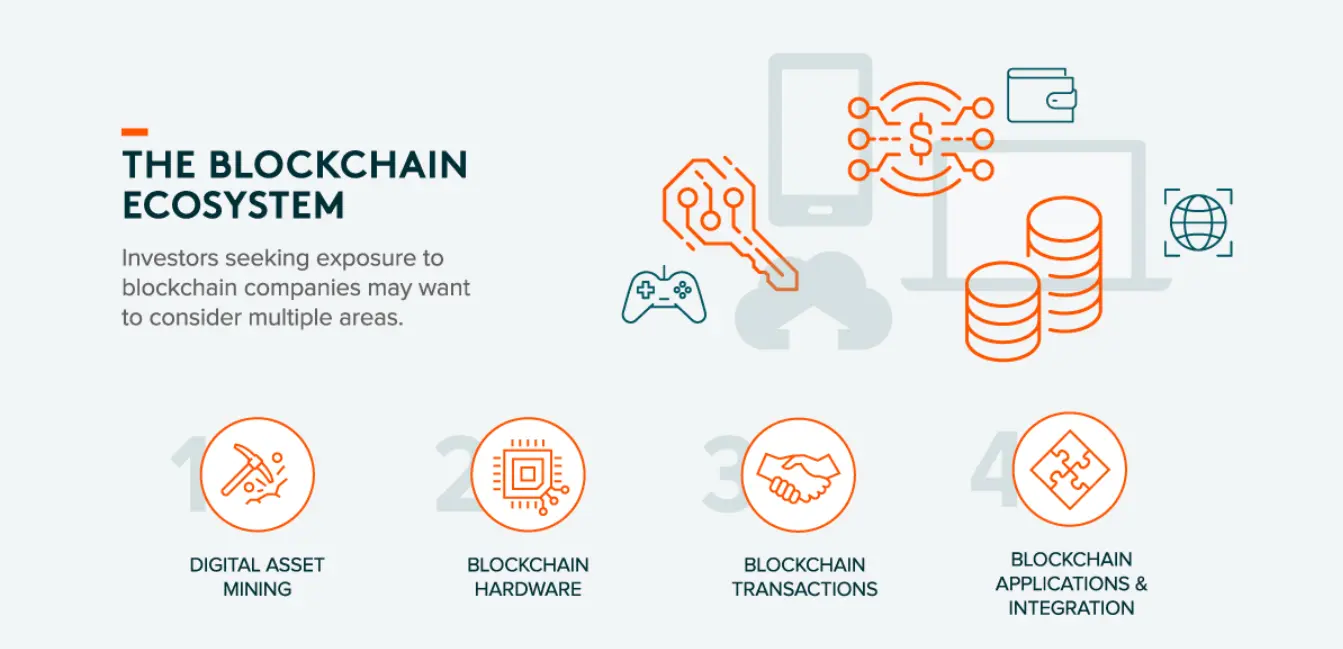

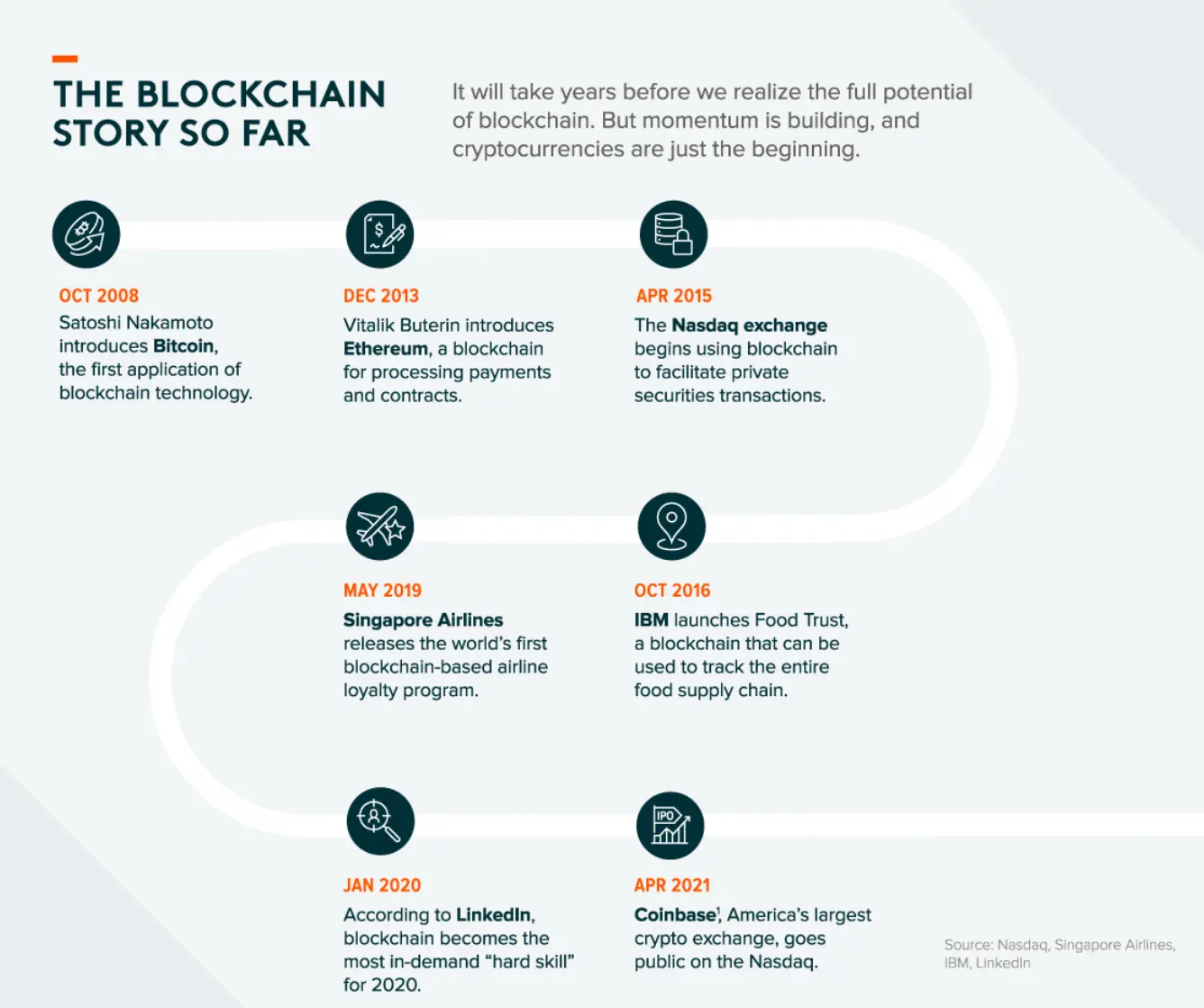

While the term "blockchain" is often used synonymously with cryptocurrencies like Bitcoin, the reality is that digital currencies are just the tip of the iceberg. Blockchain is a foundational, transformational technology with the potential to reshape entire industries, from finance and supply chain management to digital identity and entertainment. For investors, this means that the opportunity extends far beyond simply buying and holding cryptocurrencies. A more holistic approach involves investing in the entire ecosystem that enables blockchain technology to function and grow. This guide, based on an infographic from Visual Capitalist, breaks down the four key segments of the blockchain ecosystem to provide a comprehensive map for potential investors 1.

The Four Pillars of the Blockchain Ecosystem

Investing in blockchain can be diversified across four distinct but interconnected segments, each playing a crucial role in the technology's development and adoption.

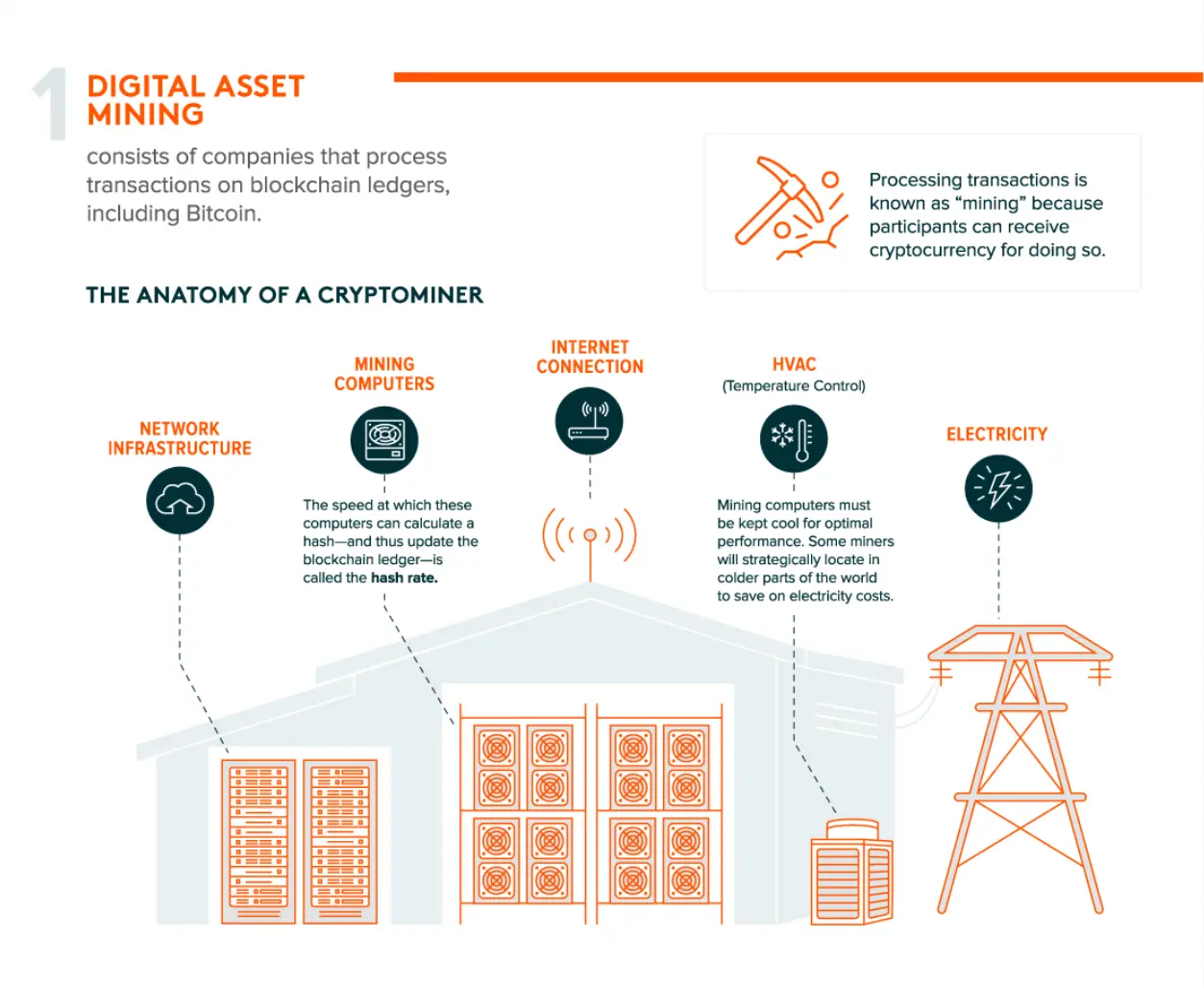

1. Digital Asset Mining

Digital asset mining is the backbone of many blockchain networks. It involves companies that operate powerful computers to process and verify transactions on a blockchain ledger. In return for their computational work, these "miners" are compensated with cryptocurrency. This segment is capital-intensive, requiring significant investment in specialized hardware, network infrastructure, and, most notably, electricity. The high energy consumption of mining has sparked environmental debates, but it remains the fundamental process that secures many of the world's most prominent blockchains 1.

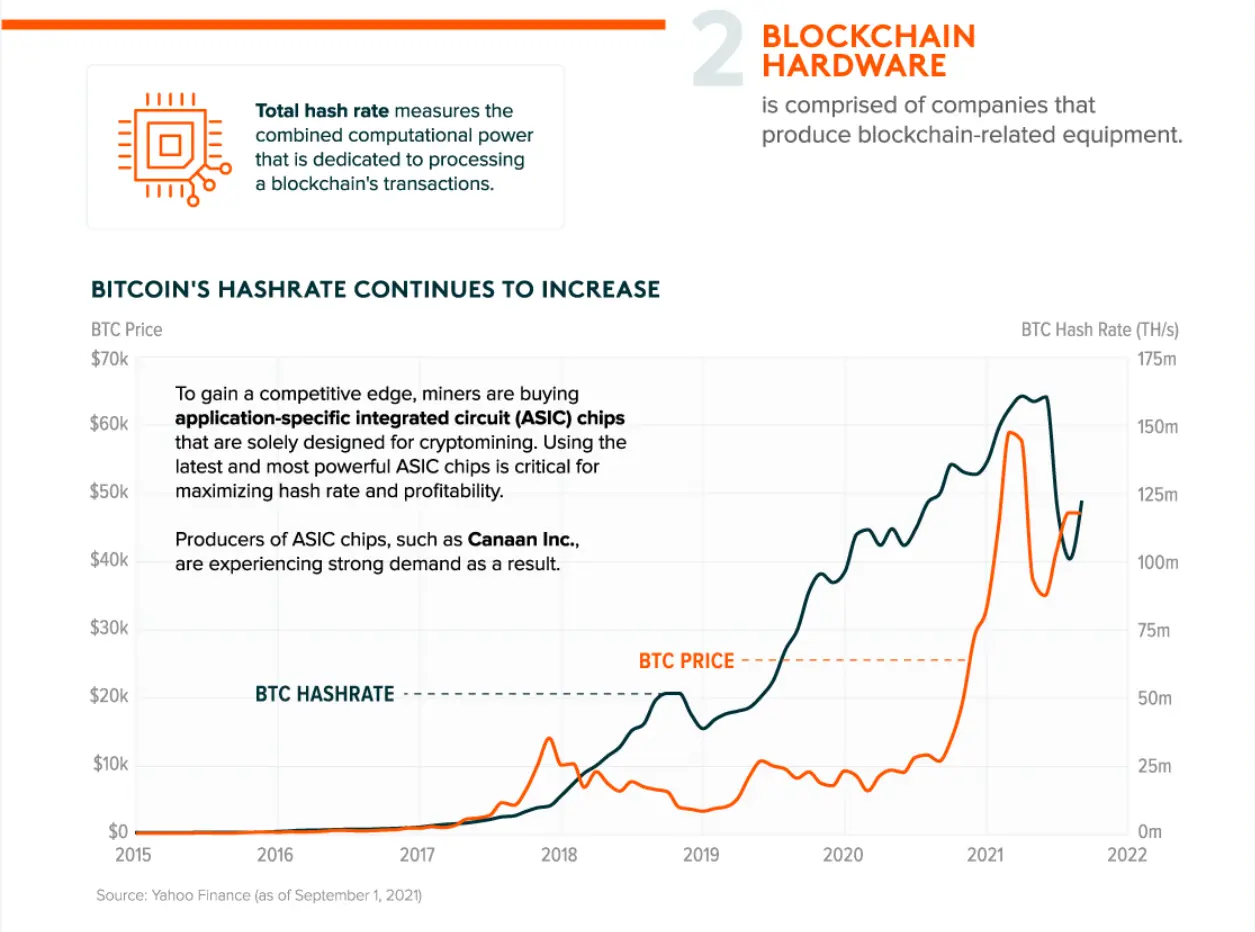

2. Blockchain Hardware

This segment comprises the companies that design and manufacture the specialized equipment required for mining and other blockchain operations. Initially, miners used high-performance Graphic Processing Units (GPUs), which were originally designed for gaming and graphics rendering. However, as the industry has matured, the focus has shifted to Application-Specific Integrated Circuit (ASIC) chips. These are custom-designed chips optimized for the singular purpose of maximizing mining efficiency and profitability. Companies that produce these essential hardware components represent a critical investment opportunity in the blockchain supply chain 1.

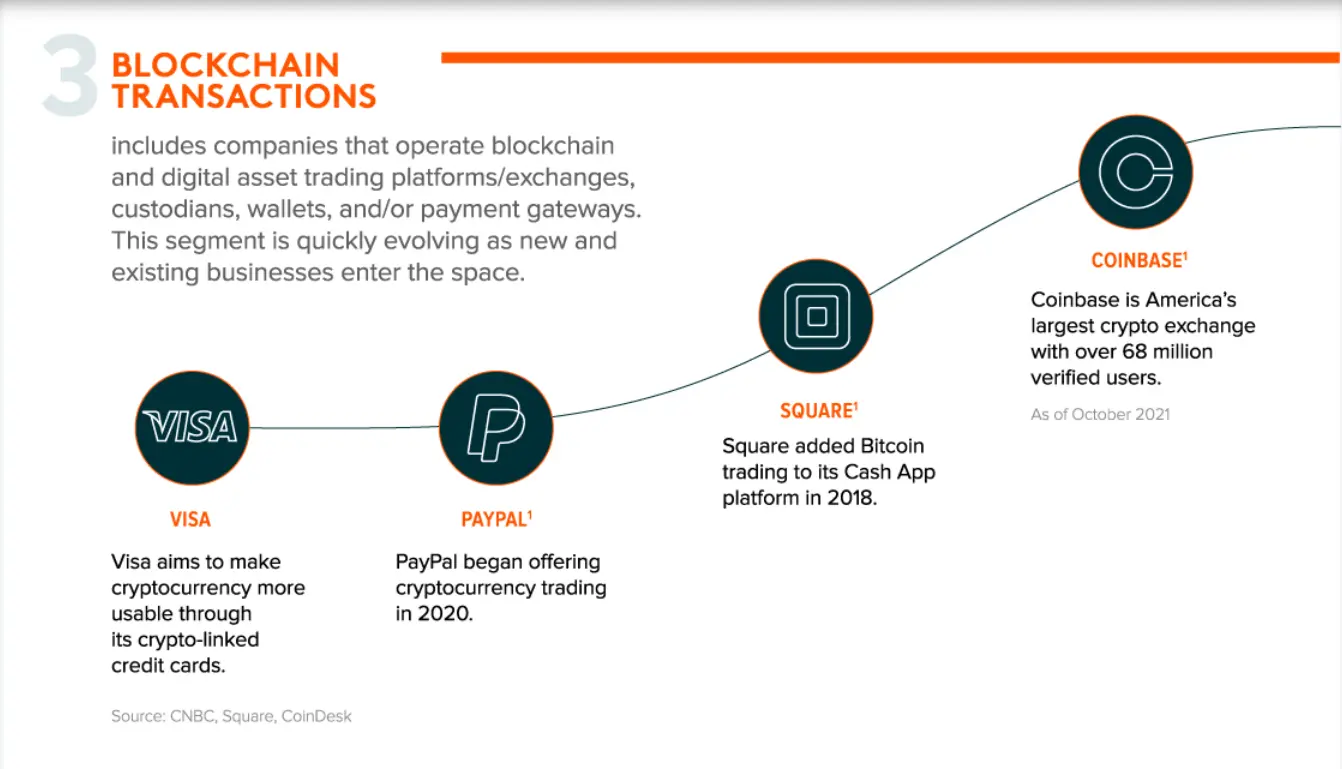

3. Blockchain Transactions

The transaction layer includes the platforms and financial services that facilitate the buying, selling, and use of digital assets. This segment has seen an explosion of growth and innovation, with both crypto-native companies and traditional financial giants entering the space.

Source: Visual Capitalist 1

These companies are building the bridges between the traditional financial system and the emerging digital asset economy, making them a vital part of the ecosystem.

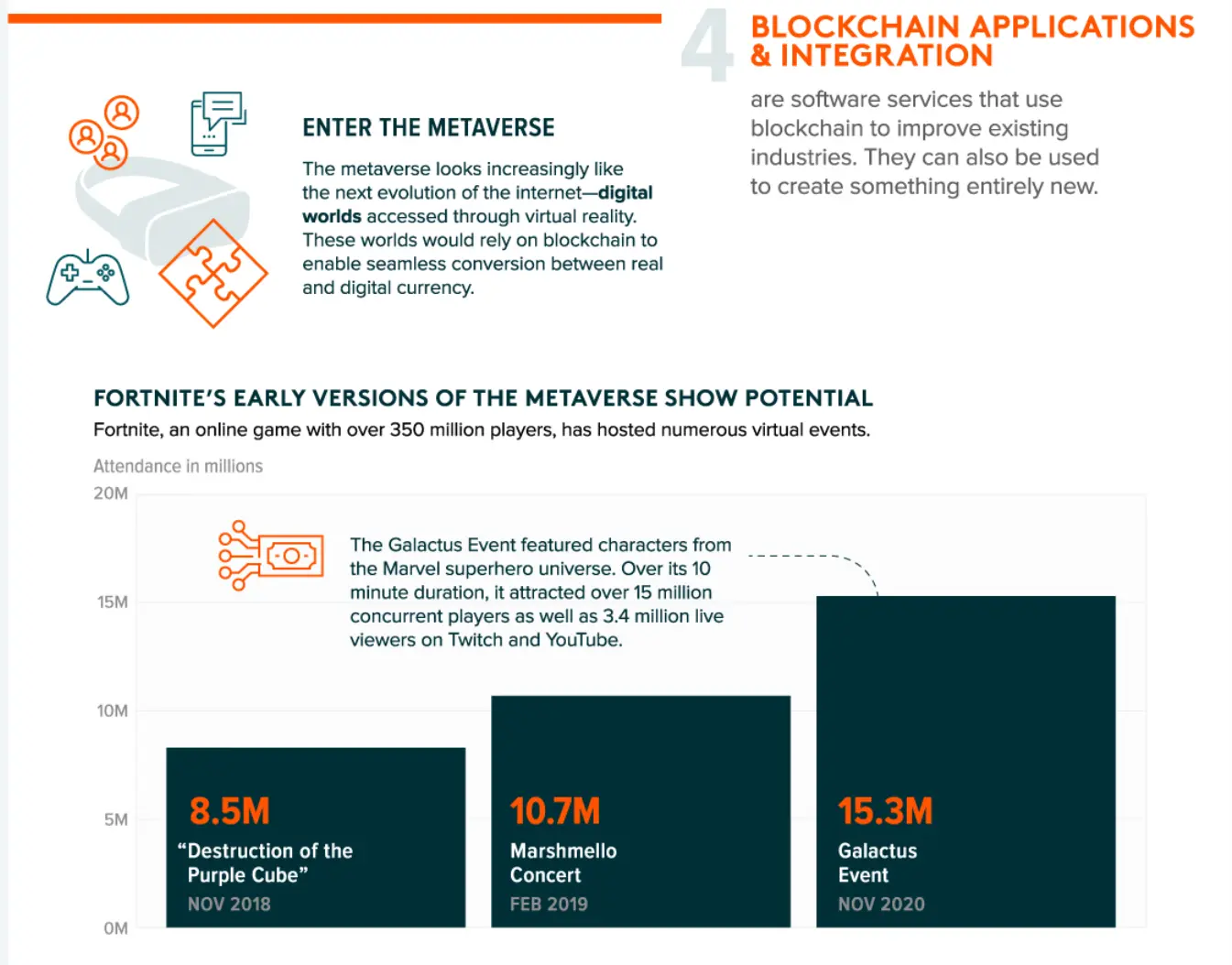

4. Blockchain Applications & Integration

This is the broadest and perhaps most exciting segment, encompassing all the software, services, and ambitious projects being built on top of blockchain technology. These applications extend far beyond simple financial transactions.

•Enterprise Solutions: Companies like IBM are using blockchain to create more transparent and efficient supply chains with products like Food Trust 1.

•The Metaverse: Ambitious projects are underway to build persistent, shared virtual worlds where users can work, socialize, and play. These metaverses will require their own digital economies, a role that blockchain is uniquely suited to fill. Tech giants like Meta (formerly Facebook) are investing billions annually in this vision 1.

Conclusion: A Diversified Approach to a Transformational Technology

Blockchain is more than just a new asset class; it is a comprehensive technological ecosystem with multiple layers of opportunity. While direct investment in cryptocurrencies remains a popular strategy, a more diversified approach involves gaining exposure to the companies that are building the infrastructure, hardware, and applications that will drive the future of this transformational technology. By understanding the four key segments of the blockchain ecosystem—mining, hardware, transactions, and applications—investors can develop a more nuanced and resilient strategy for capitalizing on one of the most significant technological shifts of our time.

SiniSa Dagary, www.sinisadagary.com