The Digital Fortress: How BitGo Became the Bedrock of Institutional Crypto

In the exhilarating and often volatile world of digital assets, the question of security is paramount. For retail investors, the mantra is “not your keys, not your coins,” a call for self-sovereignty. But for institutions—hedge funds, corporations, exchanges, and asset managers—managing billions of dollars in crypto, the equation is far more complex. The operational risks of self-custody are immense, and the history of catastrophic exchange collapses serves as a constant, grim reminder of what’s at stake. In this high-stakes environment, trust is not given; it is engineered. And for over a decade, one company has been the primary architect of that trust: BitGo.

Founded in 2013, when Bitcoin was still a niche curiosity, BitGo has methodically built the digital asset infrastructure required for institutions to enter the market with confidence. It is not merely a wallet provider; it is a fortress, a regulated financial institution, and a comprehensive technology partner that has become the institutional standard for digital asset security. By pioneering multi-signature technology, launching the first regulated, qualified custody service for crypto, and securing over $104 billion in assets across more than 9.3 million wallets, BitGo has done more than just protect assets—it has paved the way for the mainstream adoption of digital finance.

This article delves into the world of BitGo, exploring the technology, regulatory prowess, and comprehensive suite of services that have made it the #1 custodian and staking provider in the world. From its battle-tested security protocols to its recent IPO filing, we will uncover how BitGo built the bedrock upon which the future of institutional finance is being constructed.

The Institutional Dilemma: Solving the Paradox of Security and Scale

The promise of digital assets—decentralization, transparency, and 24/7 markets—also presents a unique set of challenges for large-scale investors. The very nature of blockchain means that transactions are irreversible. A lost private key or a compromised server can result in the permanent loss of billions of dollars, with no recourse. The early days of crypto were littered with the ghosts of failed exchanges and massive hacks, creating a barrier of fear and uncertainty that kept institutional capital on the sidelines.

Institutions needed a solution that could resolve this paradox: how to achieve the security of cold storage with the accessibility required for active trading and portfolio management. They needed a partner that was not just a technology vendor, but a regulated, insured, and audited fiduciary. This was the void that BitGo was built to fill.

The BitGo Solution: A Four-Pillar Infrastructure

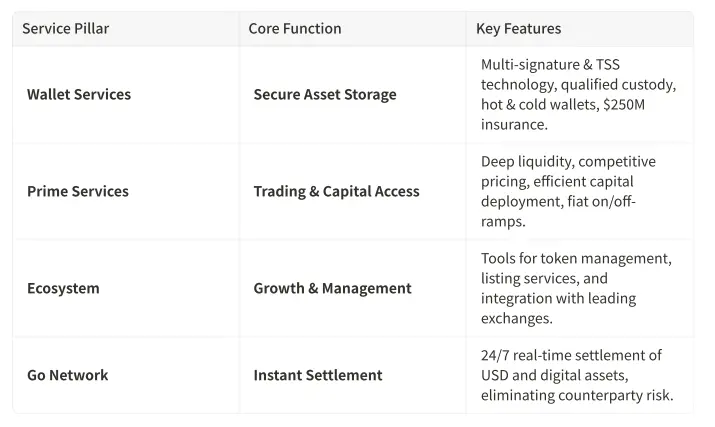

BitGo’s answer to the institutional dilemma is a comprehensive, four-pillar infrastructure that provides end-to-end services for owning, building, managing, and growing a digital asset portfolio. This integrated approach ensures that clients have a single, trusted partner for all their needs, from secure storage to seamless trading and settlement.

The Foundation: Unparalleled Wallet Security

BitGo’s reputation is built on its pioneering security technology. In 2013, the company was the first to commercialize multi-signature (multi-sig) wallets, a technology that requires multiple private keys to authorize a transaction. This eliminates the single point of failure inherent in single-key wallets. If one key is compromised, the funds remain secure. BitGo has since evolved this technology to include Threshold Signature Scheme (TSS), which offers even greater efficiency and privacy.

This technology underpins their two main wallet offerings:

1.Self-Custody Wallets: For clients who want to maintain control over their own keys, BitGo provides the software and infrastructure to manage hot (online) and cold (offline) multi-sig wallets securely.

2.Qualified Custody: This is BitGo’s flagship offering and the gold standard for institutional investors. BitGo Trust Company, a regulated entity, acts as a fiduciary and holds the assets in bankruptcy-remote, cold storage. This service comes with up to $250 million in insurance coverage, providing an unprecedented level of protection against theft or loss.

As one CEO client stated, “BitGo's security practices are world-class; they truly go the extra mile. The security gained in such a partnership is unparalleled.”

The Engine: Prime Services and the Go Network

Security is necessary, but it is not sufficient. Institutions also need the ability to trade and move assets efficiently. BitGo’s Prime Services provide a seamless gateway to liquidity, offering competitive pricing and best execution across a wide range of assets. This allows clients to trade directly from their secure custody environment, minimizing exposure to exchange counterparty risk.

This is further enhanced by the Go Network, a revolutionary real-time settlement network. The Go Network allows participating institutions to settle trades in both USD and digital assets instantly, 24/7. By holding assets in regulated custody, the network eliminates counterparty risk and allows for a clear separation of custody and trading functions—a critical requirement for modern financial risk management.

The Regulatory Vanguard: Building Trust Through Compliance

In an industry often characterized by regulatory uncertainty, BitGo has consistently leaned into compliance, viewing it not as a burden, but as a competitive advantage. The company established BitGo Trust Company in 2018, becoming a fully regulated, qualified custodian under U.S. law. This was a landmark moment for the industry, as it provided institutional investors with the fiduciary-grade protection they are legally required to use.

BitGo’s commitment to regulation is evident in its multiple licenses and its adherence to rigorous auditing standards, including SOC 1 and SOC 2 Type II audits. This proactive stance has not only built trust with clients but has also positioned BitGo as a leader in shaping the regulatory landscape. In September 2025, BitGo made headlines by becoming the first crypto custodian to file for a U.S. IPO, a bold move that signals a new era of maturity and transparency for the digital asset industry.

As another CEO client highlighted, this regulatory focus is a key differentiator: “Partnering with BitGo has enhanced our value proposition. We're able to highlight the fact that we can deliver reduced counterparty risk because we've partnered for custody with a third party that is regulated and licensed.”

The Infrastructure for Innovation

Beyond its core services, BitGo provides the foundational tools for the next wave of financial innovation. Through its “-as-a-Service” offerings, BitGo empowers other businesses to build on its secure and scalable infrastructure:

•Wallet-as-a-Service: Allows developers to seamlessly create and scale wallets for their own applications.

•Stablecoin-as-a-Service: Provides the tools to build, issue, and manage custom stablecoins.

•Crypto-as-a-Service: Offers the fastest and safest way for businesses to build on-chain functionality.

By supporting over 1,550 digital assets across 69 unique blockchains, BitGo is not just a custodian for Bitcoin and Ethereum; it is the infrastructure provider for the entire digital asset ecosystem, from tokenized real-world assets to institutional staking and decentralized finance (DeFi).

Conclusion: The Unseen Force Driving Institutional Adoption

For over a decade, BitGo has been the unseen force working in the background to make institutional crypto a reality. While the market has been captivated by soaring prices and novel applications, BitGo has been quietly and diligently building the pipes, vaults, and bridges necessary for the traditional financial world to connect with the new digital economy. The company has proven that security, compliance, and innovation are not mutually exclusive but are, in fact, the three essential ingredients for building a lasting and trustworthy financial future.

With its pioneering technology, unwavering commitment to regulation, and a comprehensive suite of services that cater to every institutional need, BitGo has cemented its position as the bedrock of the digital asset market. As the financial world continues its inevitable march toward tokenization, BitGo stands ready, not just as a participant, but as the foundational infrastructure company enabling the entire transition. For institutions looking to own their financial future, the path forward is clear, and it is secured by BitGo.