The Digital Euro: How Europe is Redefining Money for the 21st Century

As our world becomes increasingly digital, the very nature of money is undergoing a profound transformation. While we have grown accustomed to digital payments through bank cards and mobile apps, the fundamental settlement layer of our financial system has remained largely unchanged. Now, the European Central Bank (ECB) is spearheading one of the most ambitious financial projects of our time: the creation of a digital euro. This is not just another payment app or a new type of cryptocurrency; it is a Central Bank Digital Currency (CBDC)—a direct, digital liability of the central bank, equivalent to physical cash but designed for the modern economy.

The digital euro project, which officially moved into its preparation phase in late 2025, represents a pivotal step in the evolution of the single currency. It aims to ensure that, in an age dominated by private and often non-European payment solutions, citizens and businesses retain access to the safest form of money: central bank money. It is a direct response to the declining use of physical cash, the rise of private digital currencies, and the geopolitical imperative to strengthen Europe's monetary sovereignty.

This article delves into the core of the digital euro initiative. We will explore what it is, the strategic reasons driving its creation, how it is designed to function for everyday users, and the timeline for its potential rollout. We will also analyze its key features, from its robust privacy protections to its relationship with commercial banks and other digital assets, to provide a comprehensive picture of how Europe is preparing to redefine money for the 21st century.

What Exactly is a Digital Euro?

A digital euro would be the electronic equivalent of a euro banknote or coin. It would be a risk-free digital means of payment that is a direct claim on the European Central Bank, just like physical cash is today. This makes it fundamentally different from the money most of us use for digital transactions.

The money in your commercial bank account is a form of private money—it is a liability of your bank, not the central bank. While this system is highly reliable and protected by deposit insurance schemes, it still carries a sliver of commercial risk. A digital euro, as central bank money, would be the safest digital asset available to the public, backed by the full faith and credit of the Eurosystem.

Crucially, the ECB has emphasized that the digital euro is intended to complement cash, not replace it. It is designed to exist alongside physical banknotes and the private digital payment solutions offered by commercial banks, providing an additional, highly secure, and universally accepted payment option for all citizens in the euro area.

The Strategic Imperative: Why Europe Needs a Digital Euro

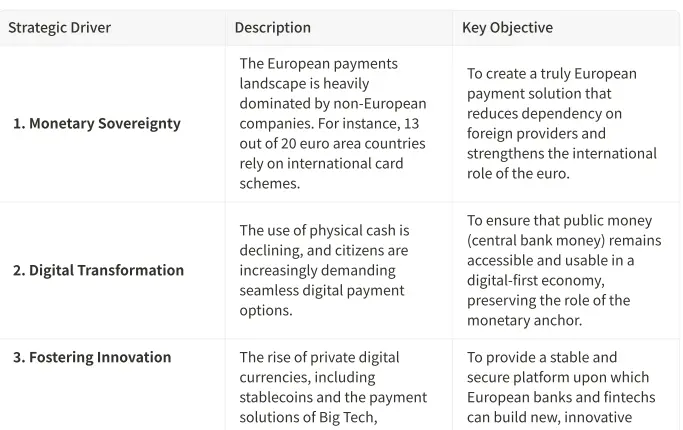

The development of a digital euro is not merely a technological upgrade; it is a strategic necessity driven by three key factors: ensuring monetary sovereignty, fostering competition and innovation, and preparing for a digital future.

By creating a digital euro, the ECB aims to provide a public backbone for the digital payments ecosystem, ensuring that the European financial system remains resilient, competitive, and autonomous in the face-pounding geopolitical and technological shifts.

How Would the Digital Euro Work for Citizens?

The ECB's vision for the digital euro is centered on simplicity, accessibility, and utility for everyday use. It is designed to be a seamless and free-of-charge payment method for all.

•Access and Storage: Citizens would be able to hold digital euro through an account or wallet provided by their existing commercial bank or a public intermediary. This ensures that the digital euro is integrated into the current financial system, not a parallel one.

•Payment Methods: Payments could be made via a smartphone app or a card, similar to today's digital wallets and contactless payments. The system is being designed to work for both online and offline transactions.

•Offline Functionality: The ability to pay offline is a critical feature, as it would allow for transactions even without an internet connection, mirroring the resilience of physical cash and ensuring usability in all situations.

•Universal Acceptance: Like cash, the digital euro would be legal tender, meaning it would have to be accepted for payment everywhere within the euro area.

Privacy by Design: A Core Principle

One of the most significant public concerns surrounding CBDCs is the potential for government surveillance. The ECB has placed privacy at the very core of the digital euro's design, aiming to replicate the privacy of cash in the digital realm.

For online payments, the digital euro would offer a level of privacy similar to current digital payment solutions, with transactions being visible to the user's payment service provider for fraud prevention and AML/CFT (Anti-Money Laundering/Combating the Financing of Terrorism) compliance. However, the Eurosystem itself would not have access to personal transaction data.

For offline payments, the digital euro would provide a level of privacy akin to cash. The details of the transaction would be known only to the payer and the payee, with no data being shared with payment service providers, the central bank, or any government entity. This cash-like privacy for offline use is a key feature designed to build public trust and ensure the digital euro serves as a true digital equivalent to banknotes and coins.

The Role of Banks and the Path to Issuance

The digital euro is not intended to disrupt the banking sector but rather to evolve with it. Commercial banks and other payment service providers will play a crucial role as the primary distributors of the digital euro to the public. They will be responsible for onboarding users, providing wallets, and offering value-added services built on top of the digital euro infrastructure.

To prevent the risk of large-scale deposit outflows from commercial banks to the central bank, especially during times of financial stress, the ECB is considering implementing holding limits on the amount of digital euro an individual can own. This would ensure that the digital euro functions primarily as a means of payment, not as a large-scale store of value, thereby preserving financial stability.

The project is currently in a multi-year preparation phase, with a potential legislative proposal expected in 2026. If all goes according to plan, the first issuance of a digital euro could happen as early as 2029. This deliberate and phased approach underscores the complexity of the project and the ECB's commitment to getting it right.

Conclusion: A Strategic Step into the Future of Money

The digital euro is far more than a technological experiment; it is a strategic and defensive maneuver to secure the future of Europe's single currency in a digital world. It is the ECB's answer to the challenges of declining cash use, the dominance of non-European payment giants, and the rise of private digital currencies. By creating a risk-free, private, and universally accessible digital form of public money, the Eurosystem aims to provide a stable anchor for the entire European payments ecosystem.

While the final design choices are still being made and the legislative process is yet to unfold, the direction of travel is clear. The digital euro is being designed to be a seamless, secure, and privacy-preserving tool for the digital age, one that complements cash and empowers citizens and businesses. It is a foundational project that will not only redefine how we use money in Europe but will also set a global benchmark for the future of central banking in the 21st century.