KYC, AML, & PEP Explained: The Three Pillars of Trust in the Digital Economy

In today’s rapidly evolving digital economy, trust is the ultimate currency. As businesses move online and financial transactions cross borders in the blink of an eye, the systems that protect the integrity of this global marketplace have become more critical than ever. Behind the scenes of every secure online bank, investment platform, or fintech app is a robust framework of regulations designed to prevent fraud, money laundering, and the financing of illicit activities. At the heart of this framework are three foundational acronyms: KYC, AML, and PEP.

For the average user, these terms might seem like technical jargon, but they represent the essential checks and balances that make digital finance possible. They are the reason you can confidently open a new bank account from your phone, invest in a startup halfway across the world, or transact in digital assets without fear of your funds being co-mingled with the proceeds of crime. Understanding these concepts is no longer just for compliance officers; it’s for anyone who wants to navigate the modern financial landscape securely and intelligently.

This article will demystify these three pillars of financial security. We will break down what Know Your Customer (KYC), Anti-Money Laundering (AML), and Politically Exposed Persons (PEP) mean, why they are crucial for a healthy financial ecosystem, and how leading technology platforms like Sumsub are making it possible for businesses to build trust and stay compliant in an increasingly complex world.

The Scale of the Challenge: A Multi-Trillion Dollar Problem

To understand why these regulations exist, one must first grasp the sheer scale of the problem they are designed to solve. Financial crime is one of the largest and most pervasive illegal industries in the world. According to the United Nations, the amount of money laundered globally in one year is estimated to be between 2% and 5% of global GDP, which translates to a staggering $800 billion to $2 trillion.

This is not a victimless crime. These funds are the lifeblood of criminal organizations, terrorist networks, and corrupt regimes. They fuel human trafficking, drug smuggling, and political corruption that destabilizes entire nations. The World Bank has estimated that over $1 trillion is paid in bribes annually, with a significant portion of that being funneled through the global financial system. This is the battleground where KYC, AML, and PEP regulations operate.

Pillar 1: KYC (Know Your Customer) – The First Line of Defense

Know Your Customer (KYC) is the foundational process of identity verification that a business must perform when it onboards a new customer. It is the most visible part of the compliance framework and the first line of defense against financial crime. At its core, KYC is about answering one simple but critical question: “Are you who you say you are?”

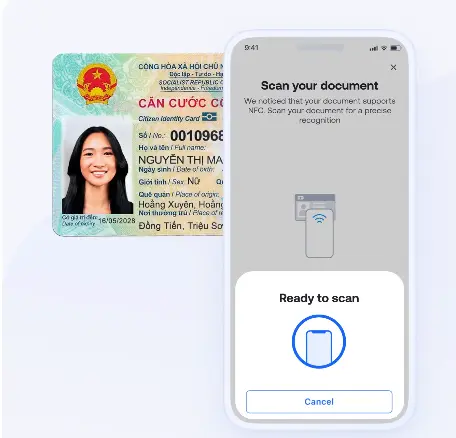

This process involves collecting and verifying a customer’s identity using reliable, independent source documents, data, or information. This typically includes:

•Customer Identification Program (CIP): Collecting basic information like name, date of birth, address, and an identification number.

•Document Verification: Checking the authenticity of government-issued IDs like passports or driver's licenses.

•Biometric Verification: Using facial recognition technology to match the person to the ID photo, preventing impersonation.

KYC is not just a one-time check. It establishes the baseline for a customer’s risk profile, which informs the level of scrutiny they will be subject to throughout their relationship with the business. A smooth, efficient, and secure KYC process is crucial. As a client of Sumsub, Clyde Zorgvol, Deputy Group Head of Compliance, noted, a powerful verification tool can have a massive impact: “After we signed with Sumsub and integrated their tool, we managed to increase the speed of verification by more than 4 times. Concurrently, the number of our clients increased by more than 3 times.”

Pillar 2: AML (Anti-Money Laundering) – The Broader Framework

If KYC is the gatekeeper, Anti-Money Laundering (AML) is the entire security system. AML refers to the comprehensive set of laws, regulations, and procedures that financial institutions must follow to prevent, detect, and report money laundering activities. KYC is a critical component of AML, but AML is much broader.

The AML framework requires businesses to:

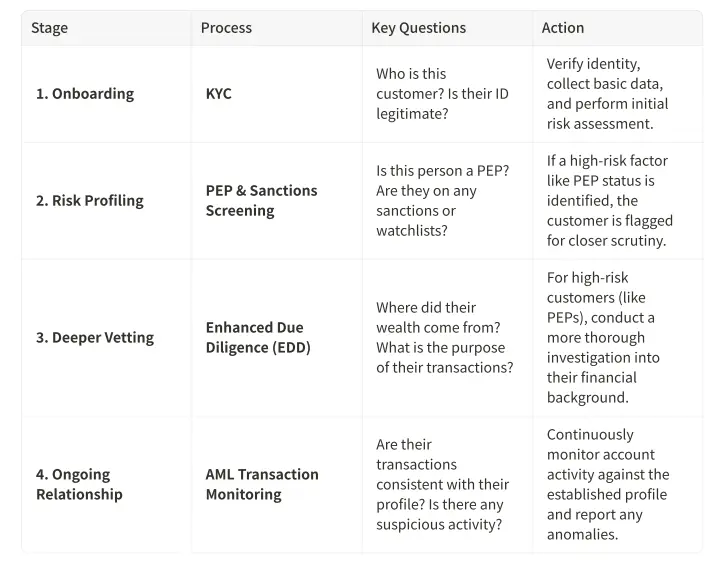

1.Conduct Customer Due Diligence (CDD): This goes beyond initial identity verification to understand the customer’s risk profile and the intended nature of their business relationship.

2.Perform Ongoing Monitoring: Businesses must continuously monitor customer transactions to detect unusual or suspicious activity that doesn’t align with their known profile.

3.Report Suspicious Activity: If a transaction raises red flags, the institution is legally obligated to file a Suspicious Activity Report (SAR) with the relevant financial intelligence unit, such as FinCEN in the United States.

Modern AML is heavily reliant on technology. Platforms like Sumsub offer sophisticated Transaction Monitoring tools that use artificial intelligence to analyze patterns and detect suspicious behavior in real-time, a capability that is essential for managing risk at scale.

Pillar 3: PEP (Politically Exposed Persons) – The High-Risk Category

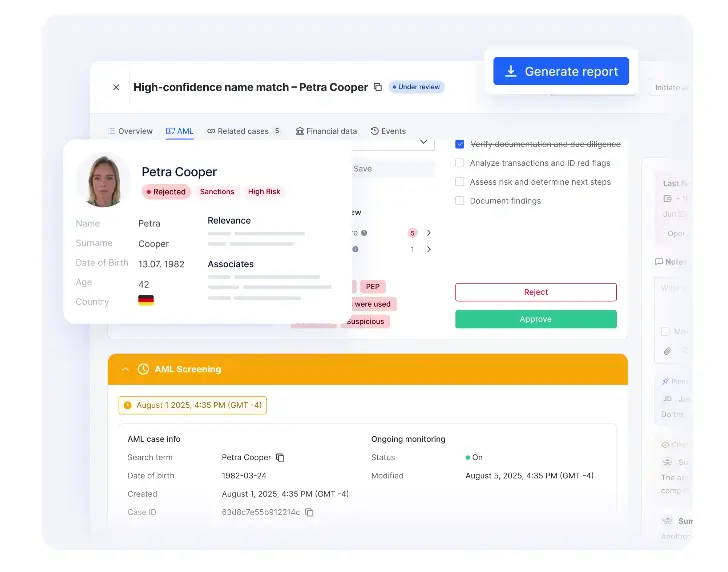

A Politically Exposed Person (PEP) is an individual who holds, or has held, a prominent public function. This includes heads of state, senior politicians, high-ranking judicial or military officials, and senior executives of state-owned corporations. The definition also extends to their immediate family members and close associates (known as Relatives and Close Associates, or RCAs).

Being a PEP does not imply any wrongdoing. However, the Financial Action Task Force (FATF), the global anti-money laundering watchdog, recognizes that the positions held by PEPs make them more vulnerable to being involved in bribery and corruption. As a result, financial institutions are required to conduct Enhanced Due Diligence (EDD) on PEPs. This involves a more thorough investigation into the customer’s source of wealth and source of funds, as well as more intensive ongoing monitoring of their transactions.

Screening for PEPs is a significant challenge, as lists of these individuals are constantly changing. This is where automated screening against comprehensive, up-to-date global databases becomes indispensable for effective compliance.

How the Three Pillars Work Together: An Integrated Process

KYC, AML, and PEP are not isolated functions; they are interconnected components of a single, risk-based compliance strategy. The process works like a funnel, with each stage informing the next.

This integrated approach ensures that compliance is not a one-time checkbox but a dynamic, ongoing process that adapts to the evolving risk profile of each customer.

The Technology That Makes It Possible: The Rise of RegTech

Manually performing these checks on a global scale would be impossible. The sheer volume of data, the complexity of regulations across different jurisdictions, and the speed at which financial transactions occur necessitate a technology-driven approach. This has given rise to the Regulatory Technology (RegTech) industry, with companies like Sumsub at the forefront.

These platforms provide a single, unified solution that automates and orchestrates the entire compliance workflow. By leveraging artificial intelligence and machine learning, they can:

•Verify identities from thousands of document types across over 220 countries and territories.

•Screen customers against a multitude of global PEP, sanctions, and criminal watchlists in real-time.

•Analyze transaction patterns to detect sophisticated money laundering schemes that would be invisible to the human eye.

•Dramatically reduce fraud, with some businesses reporting a reduction to “practically zero” after implementing a comprehensive solution.

Investing in such a platform is no longer a cost center but a significant driver of business value. A study by Forrester Consulting on the economic impact of Sumsub’s platform found that companies achieved an average Return on Investment (ROI) of 240%, with a payback period of less than six months. This is driven by increased operational efficiency, reduced fraud losses, and higher customer conversion rates due to a smoother onboarding experience.

Conclusion: Building a Future on Trust

KYC, AML, and PEP are more than just regulatory hurdles; they are the essential pillars that support the integrity and security of our global financial system. They protect businesses from reputational damage and regulatory fines, shield consumers from fraud, and help governments combat the criminal enterprises that threaten our collective security. In the digital age, a company’s commitment to robust compliance is a direct reflection of its commitment to its customers and its role as a responsible market participant.

As the financial world becomes increasingly interconnected and complex, the importance of this framework will only grow. Thanks to innovative RegTech solutions, businesses now have the power to build trust, scale globally, and stay ahead of financial crime, ensuring that the digital economy of the future is built on a foundation of safety, transparency, and security for all.