The Shifting Landscape of Global Gold Reserves - 2025 Report

Introduction

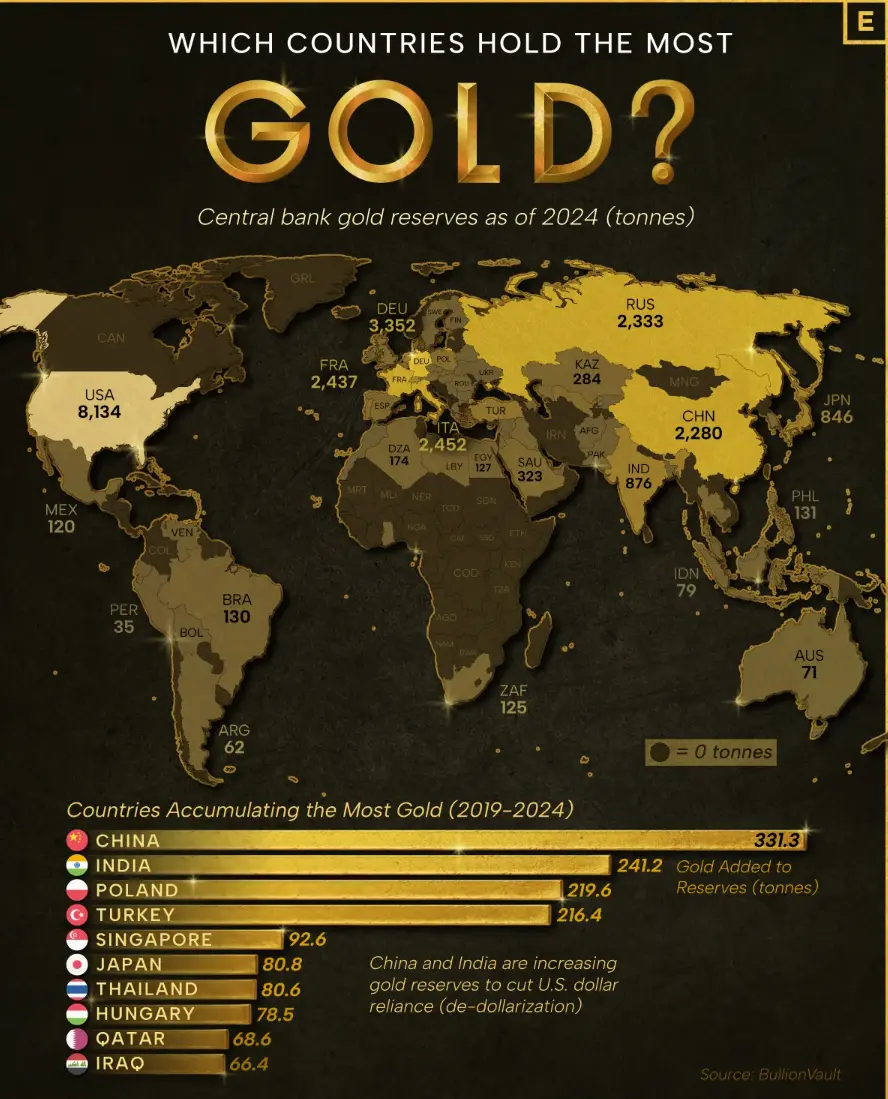

Gold, the world's most ancient and enduring store of value, is once again taking center stage in the global financial system. As of 2025, central banks are accumulating gold at record levels, driving prices to unprecedented highs and signaling a significant shift in the international economic and geopolitical landscape. This report, based on 2024 data from BullionVault via Visual Capitalist, delves into the current state of global gold reserves, examining which nations are the dominant holders and which are the most aggressive accumulators 1.

The Top Gold Holders: A Persistent Power Dynamic

The United States continues to dominate the world's gold holdings, with a staggering 8,133.5 tonnes of gold in its official reserves. This figure, which has remained largely unchanged for decades, is a testament to the nation's long-standing economic power and the strategic role of gold in underpinning confidence in the U.S. dollar. At current prices, America's gold reserves are valued at over $1 trillion, primarily stored in the high-security vaults of Fort Knox and the New York Federal Reserve 1.

European nations also maintain a strong presence at the top of the gold-holding hierarchy. Germany, Italy, and France collectively hold nearly 8,200 tonnes of gold, a legacy of the post-World War II Bretton Woods agreement, which established a gold-backed international monetary system. The following table illustrates the top 10 countries by their official gold reserves as of 2024:

Source: BullionVault, 2024 1

The Rise of Emerging Markets: A Strategy of De-Dollarization and Diversification

While the traditional economic powers maintain their dominance in gold holdings, the most significant trend in recent years has been the aggressive accumulation of gold by emerging markets. This shift is driven by a strategic desire to diversify away from the U.S. dollar, a phenomenon known as "de-dollarization," and to hedge against economic and geopolitical risks.

China and India have been at the forefront of this movement. Between 2019 and 2024, China increased its gold reserves by 331.3 tonnes, bringing its total to 2,280 tonnes. This accumulation is a key component of Beijing's strategy to internationalize the yuan and reduce its reliance on U.S. Treasury holdings. Similarly, India, now the world's fifth-largest economy, has been steadily increasing its gold reserves to bolster its financial stability 1.

Other emerging economies, such as Turkey and Poland, have also made substantial additions to their gold reserves. For these nations, gold serves as a crucial hedge against inflation, currency volatility, and geopolitical uncertainty. The following table highlights the countries that have accumulated the most gold between 2019 and 2024:

Source: BullionVault, 2019-2024 1

Conclusion

The global landscape of gold reserves is in a state of flux. While the United States and Europe continue to hold the lion's share of the world's gold, the aggressive accumulation by emerging markets, particularly China and India, signals a broader shift in the international monetary system. The trend of de-dollarization, coupled with the use of gold as a hedge against economic and geopolitical uncertainty, is likely to continue in the coming years. As such, gold's role as a strategic asset and a cornerstone of global finance remains as relevant as ever.

SiniSa Dagary, www.sinisadagary.com