The MiCA Revolution: How the EU's Landmark Crypto Regulation is Reshaping the Digital Asset Landscape

For years, the cryptocurrency market has been characterized by explosive innovation, volatile price swings, and a regulatory landscape often described as the "Wild West." While this environment fostered rapid growth, it also left investors exposed and created uncertainty for businesses. That era is now officially drawing to a close in the European Union. With the full implementation of the Markets in Crypto-Assets (MiCA) regulation in December 2024, the EU has introduced the world's first comprehensive, harmonized framework for digital assets, setting a global benchmark and fundamentally reshaping the future of the industry.

MiCA is not merely a set of rules; it is a foundational piece of the EU's broader digital finance strategy, designed to bring legal certainty to a market that has long operated in a gray area. By establishing clear guidelines for everything from stablecoin issuance to the operation of crypto exchanges, MiCA aims to achieve a delicate balance: fostering innovation while ensuring robust investor protection, market integrity, and financial stability. For the estimated 31 million crypto users in Europe and the countless businesses building on blockchain technology, MiCA represents a pivotal shift from ambiguity to clarity.

This article provides a comprehensive overview of the MiCA regulation. We will explore the problems it solves—from the fallout of exchange collapses like FTX to the systemic risks posed by unregulated stablecoins—and break down its core components and phased implementation. We will also examine the specific, granular requirements it places on different types of crypto-assets and service providers, and discuss its profound implications for the future of the digital asset economy, both within the EU and across the globe through the phenomenon known as the "Brussels Effect."

From Chaos to Clarity: The Core Pillars of MiCA

At its heart, MiCA seeks to replace the fragmented patchwork of national laws across the EU with a single, unified rulebook. This harmonization is crucial, as it introduces "passporting rights" for crypto-asset service providers (CASPs). This means that once a company is authorized in one EU member state, it can offer its services across the entire bloc of 27 countries, creating a true single market for digital assets.

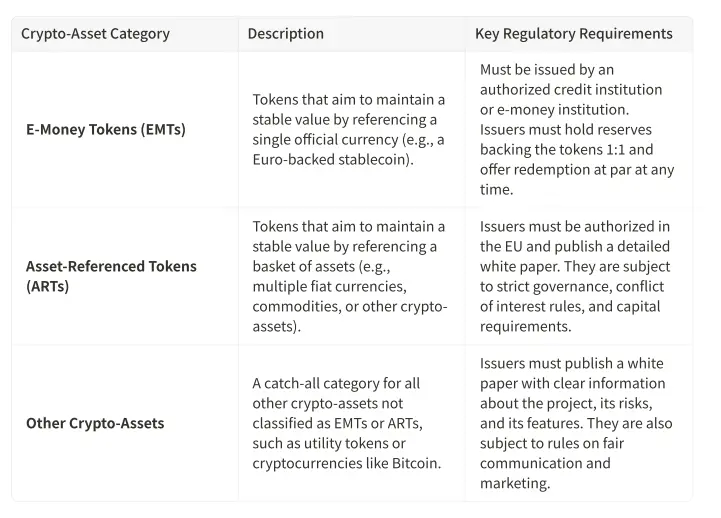

The regulation categorizes crypto-assets into three main types, each with its own specific set of rules, recognizing that not all digital assets carry the same risks or serve the same purpose.

The Three Categories of Crypto-Assets under MiCA

MiCA introduces a clear taxonomy for crypto-assets, ensuring that regulation is proportionate to the risks associated with each type.

A catch-all category for all other crypto-assets not classified as EMTs or ARTs, such as utility tokens or cryptocurrencies like Bitcoin.

Issuers must publish a white paper with clear information about the project, its risks, and its features. They are also subject to rules on fair communication and marketing.

This tiered approach allows MiCA to impose the strictest rules on stablecoins (EMTs and ARTs), which are seen as having the greatest potential to impact financial stability—a lesson learned from the 2022 collapse of the Terra/LUNA ecosystem, which wiped out billions in value and highlighted the dangers of algorithmic stablecoins. By providing a lighter-touch, disclosure-based regime for other crypto-assets, the EU aims to avoid stifling innovation in the broader blockchain space.

Regulating the Gatekeepers: Requirements for Crypto-Asset Service Providers (CASPs)

Beyond regulating the assets themselves, MiCA establishes a comprehensive framework for the entities that provide services related to them. Any firm offering services such as exchanges, custody (wallet provision), or crypto-asset trading advice within the EU must become an authorized CASP.

Key obligations for CASPs include:

•Authorization: Obtaining a license from a national competent authority in an EU member state.

•Prudential Safeguards: Maintaining minimum capital reserves to ensure operational resilience.

•Governance: Establishing robust internal governance arrangements, including clear organizational structures and conflict of interest policies.

•Investor Protection: Acting honestly, fairly, and professionally in the best interests of their clients. This includes providing clear information about risks and costs.

•Custody Rules: Segregating client assets from their own and ensuring the security of funds.

•Market Abuse Prevention: Implementing robust systems to detect and prevent market abuse. This explicitly includes prohibitions on insider dealing, the unlawful disclosure of inside information, and market manipulation techniques like wash trading or front-running, bringing crypto markets in line with the standards of traditional financial markets.

A Phased Rollout: The Implementation Timeline

Recognizing the complexity of the new framework, the EU opted for a phased implementation to give the market time to adapt. The rollout is structured in two key stages:

•Phase 1 (Effective June 30, 2024): This initial phase brought the rules for stablecoins (EMTs and ARTs) into effect. This prioritization reflects the regulators' focus on addressing the assets with the most immediate potential to scale and impact the broader financial system.

•Phase 2 (Effective December 30, 2024): This final phase makes the entire regulation fully applicable, bringing all other crypto-assets and, crucially, all Crypto-Asset Service Providers (CASPs) under the new regime. From this date, any entity providing crypto services in the EU must be fully compliant and authorized.

This staggered approach allowed stablecoin issuers to prepare for the stringent requirements first, while giving exchanges and other service providers a longer runway to implement the necessary compliance, governance, and security measures.

The Global Ripple: MiCA and the "Brussels Effect"

MiCA’s impact extends far beyond the EU’s borders. The regulation is a prime example of the "Brussels Effect," a term describing the EU's unilateral power to regulate global markets. Because the EU is such a large and lucrative market (home to an estimated 31 million crypto users), international crypto firms cannot afford to ignore it. To access this market, companies based in the US, Asia, and elsewhere will need to comply with MiCA's standards. In many cases, it is simpler for these global firms to adopt the EU's high standards as their global baseline rather than creating different products and compliance frameworks for different regions.

As a result, MiCA is effectively setting a de facto international standard for crypto-asset regulation. Jurisdictions like the UK, Australia, and even parts of the United States are now developing their own regulatory frameworks with a close eye on MiCA's structure. This global harmonization, driven by the EU, is expected to create a more predictable and stable environment for the entire digital asset industry, reducing regulatory arbitrage and fostering greater cross-border cooperation.

The New Sheriffs in Town: Supervision and Enforcement

MiCA establishes a dual-layer supervision model. The primary responsibility for authorizing and supervising CASPs lies with the National Competent Authorities (NCAs) of each member state. However, to ensure consistent application of the rules and to oversee the largest players, the European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA) are given significant powers.

ESMA is tasked with developing the detailed technical standards that underpin MiCA and maintaining a public register of all authorized CASPs. The EBA, meanwhile, will directly supervise "significant" stablecoin issuers—those with over 15 million active users or other systemic importance—to mitigate any risks they could pose to financial stability. This collaborative approach aims to combine local market expertise with centralized oversight for the most critical components of the crypto ecosystem. However, this supervision model has drawn some criticism, with figures like ECB Supervisory Board member Elizabeth McCaul warning of potential "gaps in the framework," as the 15-million-user threshold might exclude some major global exchanges from direct EU-level supervision, leaving them under the purview of potentially less-resourced national authorities.

Conclusion: Setting the Global Standard

With the implementation of MiCA, the European Union has moved decisively to end the regulatory uncertainty that has long defined the crypto industry. It has created a clear, comprehensive, and harmonized framework that provides legal certainty for businesses and robust protection for investors. While some in the industry have raised concerns about the compliance burden, the overwhelming consensus is that MiCA is a landmark achievement that will foster trust, maturity, and mainstream adoption.

By providing a clear path to regulatory compliance and offering the coveted "passporting" rights, the EU is positioning itself as a premier global hub for crypto innovation. MiCA is more than just a set of rules; it is a clear signal to the world that digital assets are a permanent and integral part of the future of finance. As other jurisdictions, including the US and the UK, continue to develop their own regulatory approaches, they will undoubtedly look to MiCA as the blueprint. The era of the Wild West is over; the age of regulated, mainstream crypto has begun, and it started in Europe.