The Future of Ownership: How Blockchain is Tokenizing Real-World Asset

Introduction

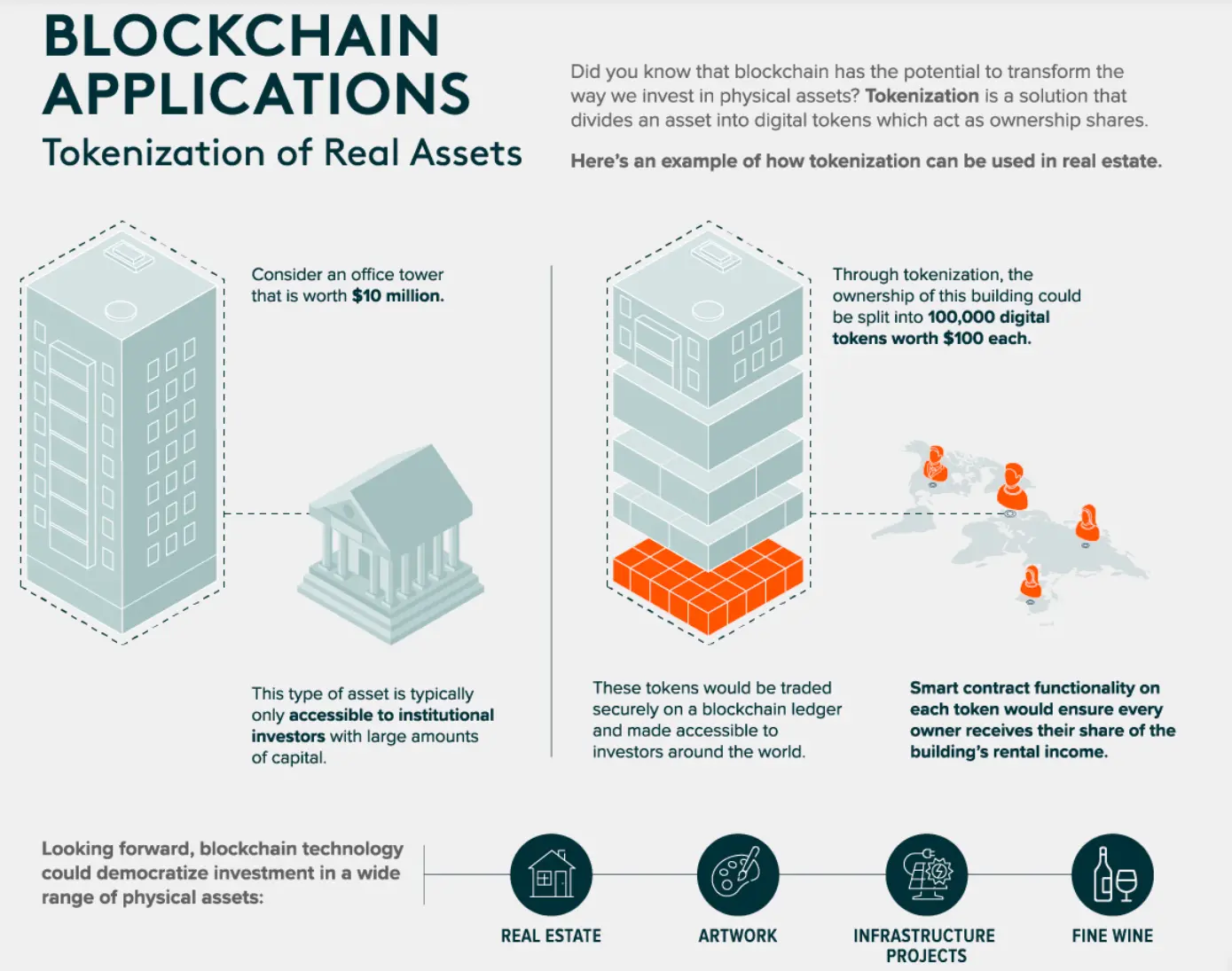

For centuries, high-value physical assets such as commercial real estate, fine art, and rare collectibles have been the exclusive domain of institutional investors and the ultra-wealthy. The high costs, lack of liquidity, and complex legal processes associated with these assets have created significant barriers to entry for the average person. However, a powerful application of blockchain technology—tokenization—is poised to dismantle these barriers and democratize access to a new world of investment opportunities 1.

What is Tokenization?

Tokenization is the process of converting the ownership rights of a physical asset into digital "tokens" that can be stored and traded on a blockchain. Each token represents a fractional share of the underlying asset, much like a stock represents a share in a company. For example, a $10 million office building, traditionally accessible only to large investment firms, can be tokenized into 100,000 digital tokens worth $100 each. These tokens can then be bought and sold by investors around the globe on a secure and transparent digital ledger 1.

This process combines the tangible value of real-world assets with the efficiency, security, and accessibility of blockchain technology.

The Transformative Benefits of Tokenizing Real Assets

The application of tokenization, particularly in illiquid markets like real estate, offers several transformative advantages that address long-standing challenges for investors.

•Enhanced Liquidity: Traditional real estate transactions are notoriously slow and cumbersome, often taking months to complete. Tokenization streamlines this process by enabling near-instantaneous peer-to-peer transfers of ownership, cutting out intermediaries and creating a more liquid market.

•Lower Barriers to Entry: By enabling fractional ownership, tokenization allows individuals to invest in high-value assets with small amounts of capital. Instead of needing millions to buy a building, an investor can purchase a single token for a fraction of the price, gaining exposure to the asset's potential returns, such as rental income, which can be automatically distributed via smart contracts 1.

•Greater Transparency and Security: Blockchains are decentralized and immutable ledgers, meaning that every transaction is recorded and verified by a network of users, making it incredibly difficult to alter or tamper with ownership records. This provides investors with a transparent history of transactions and an undeniable proof of ownership, significantly reducing the risk of fraud 1.

Beyond Real Estate: A New Frontier for Alternative Investments

The potential of tokenization extends far beyond real estate. It can be applied to a wide range of alternative and luxury assets that have historically been difficult to access and trade. This includes fine art, collector cars, rare whisky, and even infrastructure projects. The market for these luxury goods has shown significant returns over the past decade, and tokenization could unlock this value for a much broader audience.

Source: Knight Frank (December 2020) 1

The move by traditional institutions like Sotheby's, which now accepts cryptocurrency for payments, signals a growing acceptance of digital assets in the world of high-value collectibles. Tokenization is the next logical step in this evolution, promising to create more efficient, transparent, and accessible markets for these unique assets 1.

Conclusion

Tokenization represents a paradigm shift in how we think about ownership and investment. By converting illiquid, high-value physical assets into tradable digital tokens, blockchain technology is creating a more inclusive and efficient financial system. This democratization of investment has the potential to unlock trillions of dollars in value currently locked up in real-world assets, offering a new universe of opportunities for investors worldwide.

SiniSa Dagary, www.sinisadagary.com