The Future of Fundraising: How Tokenization is Fueling the Next Generation of Startups

For decades, the path for a promising startup to secure funding has been a narrow and arduous one, almost exclusively running through the hallowed halls of venture capital firms and angel investors. This traditional model, while responsible for building titans of industry, is notoriously exclusive, slow, and illiquid. It locks out the vast majority of the public from participating in the growth of early-stage companies and forces founders into lengthy, complex negotiations that can divert focus from building their business.

But the landscape of capital formation is undergoing a seismic shift, driven by the same blockchain technology that powers cryptocurrencies. A new model is emerging, one that promises to democratize access to startup investing, accelerate the fundraising process, and create a more efficient and transparent market for all. This is the era of tokenized fundraising, a revolutionary approach that is leveling the playing field and fueling the next generation of innovation.

Through Security Token Offerings (STOs), startups can now convert real-world assets—such as equity, debt, or a share of future revenue—into digital tokens that can be issued, traded, and managed on a blockchain. This is not the unregulated chaos of the 2017 ICO boom; this is a compliant, secure, and regulated evolution that combines the best of traditional finance with the power of decentralized technology. This article explores how tokenization is dismantling the old barriers to fundraising and why it represents the future for both visionary founders and savvy investors.

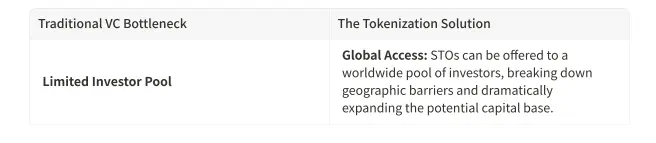

The Bottlenecks of Traditional Venture Capital

To appreciate the scale of the tokenization revolution, it’s important to understand the limitations of the system it is disrupting. The traditional venture capital model, for all its successes, is defined by a series of bottlenecks that stifle efficiency and limit participation.

•Exclusivity and Limited Access: VC funding is an insider’s game, accessible only to a small network of accredited investors and institutions. The average person, regardless of their belief in a startup’s potential, is locked out.

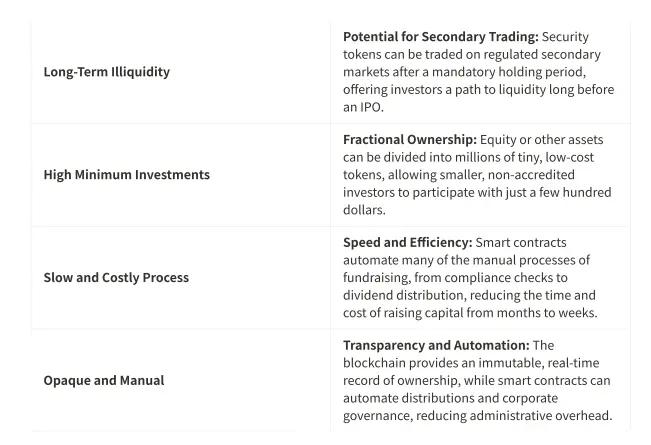

•Extreme Illiquidity: When an investor puts money into a startup, that capital is typically locked up for 7-10 years, with no way to exit until a major liquidity event like an IPO or acquisition occurs.

•Geographic Barriers: Fundraising is often a localized endeavor. A startup in a secondary market has a much harder time accessing capital from major hubs like Silicon Valley or New York.

•High Costs and Inefficiency: The fundraising process is a grueling marathon of pitches, negotiations, and legal due diligence that can take months, costing founders precious time and significant legal fees.

•Lack of Transparency: The terms of VC deals are often opaque, and the process of tracking ownership and distributions can be a complex administrative burden.

These challenges have created a system that is ripe for disruption. Tokenization addresses each of these pain points directly, offering a model that is more open, efficient, and aligned with the needs of a modern global economy.

Tokenization: A New Paradigm for Capital Formation

Tokenized fundraising through STOs represents a fundamental upgrade to the venture capital model. By representing traditional securities as digital tokens on a blockchain, startups can unlock a powerful combination of benefits that were previously unattainable.

1. Democratizing Access for Investors

The most profound impact of tokenization is its ability to democratize access to early-stage investments. Through fractional ownership, a startup can divide its equity into millions of digital tokens, allowing everyday investors to buy a small stake in a company they believe in. This not only unlocks a massive new pool of capital for founders but also allows a broader community to share in the wealth creation of the next wave of tech giants. It transforms customers and supporters into true stakeholders, creating a powerful, engaged community around a project.

2. Unlocking Liquidity for a Traditionally Illiquid Asset

The promise of liquidity is a game-changer for startup investing. In the traditional model, an early investor’s money is locked up for years. With tokenization, the potential exists for these security tokens to be traded on regulated alternative trading systems (ATS) or specialized security token exchanges. This provides investors with an exit ramp and the flexibility to manage their portfolio, making early-stage investing a far more attractive proposition.

3. Streamlining the Fundraising Process

For founders, the efficiency gains are immense. By using a tokenization platform, much of the fundraising infrastructure is already in place. Smart contracts can automate KYC/AML compliance, the distribution of tokens, and even future dividend or revenue-share payments. This drastically reduces the legal and administrative burden, allowing founders to close funding rounds faster and get back to what they do best: building their company.

4. Building a Community of Evangelists

When you open up your funding round to a global community of small investors, you are doing more than just raising capital; you are building an army of evangelists. Token holders have a vested interest in the success of the project. They become your most passionate customers, your most vocal marketers, and your most loyal supporters. This community-driven approach can be a powerful competitive advantage, especially for consumer-facing startups.

The Mechanics of a Security Token Offering (STO)

An STO is a structured and regulated process that combines the legal rigor of traditional securities with the technological efficiency of the blockchain. While the specifics can vary, a typical STO follows a clear, compliant path:

1.Asset & Legal Structuring: The startup first decides what it wants to tokenize—be it equity, a debt instrument, or a share of future revenue. It then works with legal experts to structure the offering in a way that complies with the securities laws of the jurisdictions where it plans to raise funds.

2.Choosing a Tokenization Platform: The company selects a technology partner, like Securitize, Polymath, or a comprehensive digital finance platform like Slaff.io, to handle the technical aspects of the token creation, management, and distribution.

3.Investor Onboarding (KYC/AML): All potential investors must go through a mandatory Know Your Customer (KYC) and Anti-Money Laundering (AML) verification process. This ensures that all participants are legitimate and that the offering complies with financial crime regulations.

4.The Offering: The STO is launched, and accredited or qualified investors can purchase the security tokens directly from the platform, typically using either fiat currency or major cryptocurrencies.

5.Post-Offering Management: After the sale, the tokens are distributed to the investors' digital wallets. The blockchain now serves as the official cap table, providing a real-time, immutable record of ownership. Any future actions, such as dividend payments or shareholder voting, can be automated via smart contracts.

The Role of Regulation: Why Compliance is Key

It is crucial to distinguish STOs from the unregulated Initial Coin Offerings (ICOs) of the past. Security tokens are, as the name implies, securities. They represent a real financial stake in a company and are therefore subject to securities laws. This is not a bug; it is a feature.

This regulatory wrapper provides a layer of investor protection that is essential for building a sustainable market. It ensures that offerings are transparent, that investors are properly vetted, and that there is legal recourse in the event of fraud. For serious founders and investors, this compliance is what transforms tokenization from a novel idea into a viable and trustworthy capital-raising strategy.

Conclusion: The Democratization of Venture Capital is Here

The traditional walls of venture capital are being dismantled, not by a wrecking ball, but by the quiet, persistent logic of technology. Tokenization is fundamentally rewiring the infrastructure of fundraising, creating a system that is more efficient, more transparent, and more accessible for everyone. It offers startups a powerful new tool to access a global pool of capital and build engaged communities, all while streamlining the administrative complexities of raising funds.

For investors, it unlocks a new asset class, providing the opportunity to get in on the ground floor of the next wave of innovation, with the potential for liquidity that was previously unimaginable. The future of fundraising will not be confined to Sand Hill Road; it will be global, digital, and distributed on the blockchain. The next generation of unicorns is being funded today, and thanks to tokenization, everyone has a chance to be part of the journey.