Understanding the Tokenization Process: How Real-World Assets Become Digital Tokens

The digital transformation of finance is accelerating, and at its core lies a revolutionary process called tokenization. This technology is fundamentally changing how we own, trade, and invest in assets by converting physical and tangible items into digital tokens on a blockchain. But how exactly does this transformation occur? In this comprehensive guide, we will walk through the complete tokenization process, from real-world assets to tradeable digital tokens.

What is Asset Tokenization?

Asset tokenization is the process of converting ownership rights in a tangible or intangible asset into a digital token on a blockchain. These tokens represent a claim on the underlying asset and can be traded, transferred, or held just like traditional securities, but with significantly greater efficiency, transparency, and accessibility.

The beauty of tokenization lies in its versatility. Almost any asset with value can be tokenized—real estate properties, precious metals, commodities, artwork, intellectual property, or even revenue streams. This opens up investment opportunities that were previously accessible only to wealthy individuals or institutional investors.

The Tokenization Process: A Step-by-Step Journey

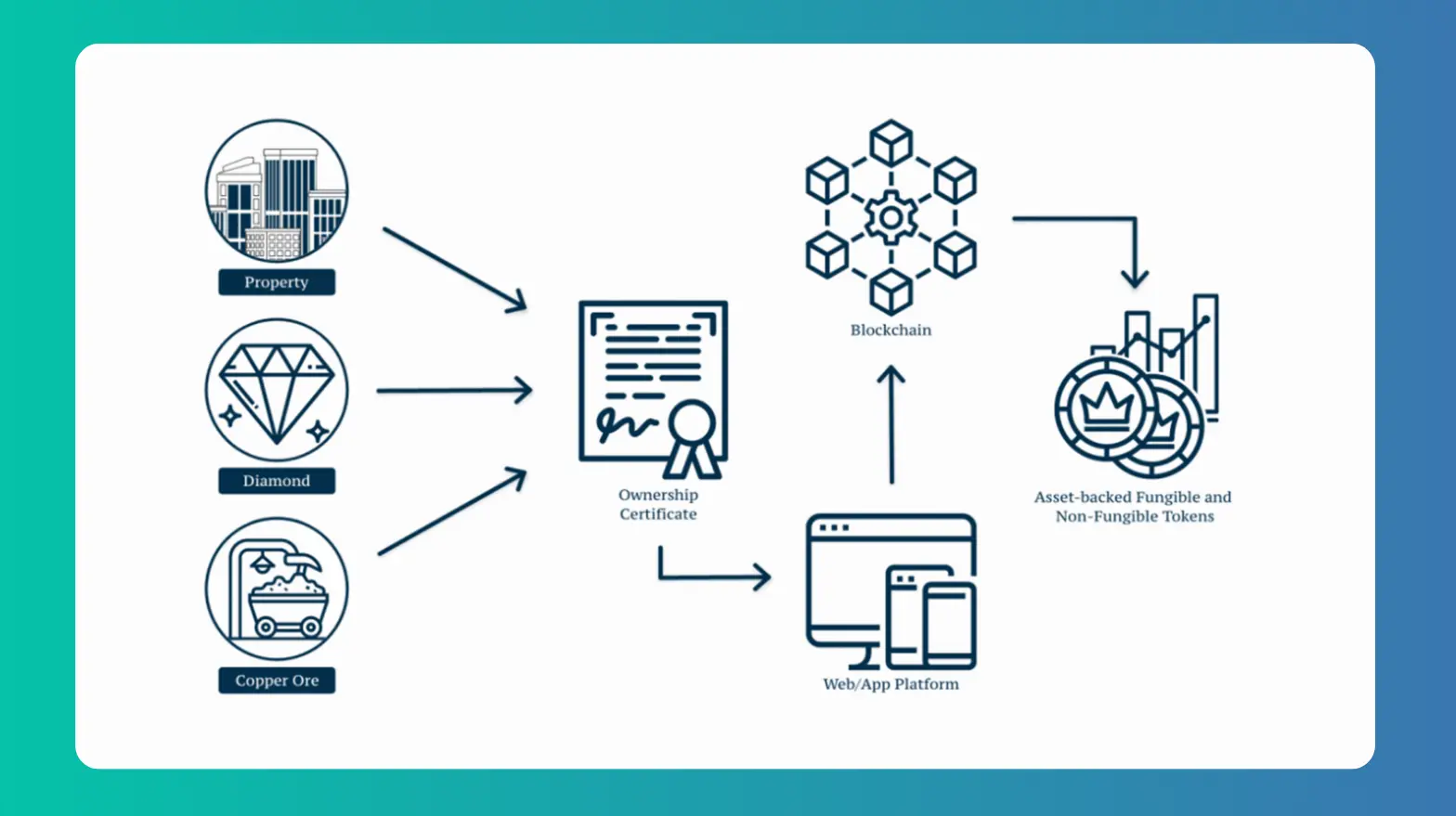

The diagram below illustrates the complete tokenization workflow, showing how diverse real-world assets are transformed into blockchain-based digital tokens that can be accessed through modern platforms.

Figure 1: The Asset Tokenization Process Flow

Let us break down each stage of this transformative process:

Step 1: Identifying the Asset

The tokenization journey begins with selecting the asset to be digitized. As shown in the diagram, this can include:

Property (Real Estate): Commercial buildings, residential properties, land parcels, or even fractional ownership in large developments. Real estate tokenization is one of the most promising applications, with the market projected to reach $4 trillion by 2035 according to Deloitte [1].

Diamonds and Precious Gems: High-value assets like diamonds, which traditionally suffer from liquidity issues, can be tokenized to enable fractional ownership and easier trading.

Copper Ore and Commodities: Raw materials and commodities can be tokenized, allowing investors to gain exposure to physical resources without the complexities of storage and logistics.

Each of these assets has intrinsic value, but they share common challenges: illiquidity, high barriers to entry, complex ownership transfer processes, and limited accessibility for smaller investors. Tokenization addresses all of these issues.

Step 2: Creating the Ownership Certificate

Once the asset is identified, the next critical step is establishing legal ownership and creating a digital representation of that ownership. This involves:

Legal Structuring: The asset is typically placed into a Special Purpose Vehicle (SPV) or trust structure. This legal entity holds the physical asset while the tokens represent ownership stakes in that entity.

Due Diligence and Valuation: Professional appraisers assess the asset's value, verify its authenticity, and ensure clear title or ownership. For real estate, this includes property inspections, title searches, and market valuations. For commodities like diamonds or copper ore, certification and quality assessments are performed.

Ownership Certificate Creation: A formal ownership certificate is generated, documenting the asset's details, valuation, legal structure, and the rights conferred to token holders. This certificate serves as the bridge between the physical world and the digital blockchain.

The ownership certificate is crucial because it establishes the legal foundation for the tokens. Token holders are not merely buying digital code—they are acquiring legally enforceable rights to the underlying asset.

Step 3: Blockchain Integration

With the ownership certificate established, the asset is ready to be represented on a blockchain. This is where the true transformation occurs:

Smart Contract Development: Developers create smart contracts that define the rules governing the tokens. These self-executing contracts automatically enforce terms such as dividend distributions, voting rights, transfer restrictions, and compliance requirements.

Token Creation (Minting): The ownership is divided into a specific number of tokens. For example, a $10 million property might be divided into 10 million tokens, each representing $1 of ownership. This fractionalization is what democratizes access—investors can now purchase as little or as much as they desire.

Blockchain Recording: The tokens are minted and recorded on a blockchain network. Popular platforms include Ethereum, Polygon, Stellar, and specialized real estate blockchains. The blockchain provides an immutable, transparent ledger of all token ownership and transactions.

The blockchain serves as the permanent record of ownership. Unlike traditional property records that may be stored in disparate government offices or paper files, blockchain records are instantly accessible, tamper-proof, and globally verifiable.

Step 4: Token Distribution via Web/App Platform

The final stage makes the tokens accessible to investors through user-friendly digital platforms:

Asset-Backed Fungible and Non-Fungible Tokens: Depending on the asset and structure, tokens can be either fungible (interchangeable, like shares of stock) or non-fungible (unique, like an NFT representing a specific property unit). Most investment tokens are fungible, allowing for liquid secondary markets.

Trading Platforms: Specialized platforms and exchanges list the tokenized assets, providing interfaces where investors can browse opportunities, conduct due diligence, purchase tokens, and manage their portfolios. These platforms often integrate with traditional payment systems and crypto wallets.

Investor Access: Through web browsers or mobile applications, investors from around the world can access these tokenized assets. A small investor in Southeast Asia can own a fraction of a commercial building in New York, or a European investor can hold tokens representing copper ore reserves in South America.

Ongoing Management: The platform handles ongoing asset management, including rent collection (for real estate), dividend distributions, compliance reporting, and providing transparency through real-time data on asset performance.

Key Benefits of the Tokenization Process

The tokenization process delivers transformative benefits across the investment ecosystem:

Increased Liquidity: Assets that traditionally take months to sell can be traded in minutes on secondary markets. Token holders can exit positions without waiting for the entire asset to be sold.

Fractional Ownership: High-value assets become accessible to retail investors. Instead of needing $1 million to invest in commercial real estate, an investor might start with just $100.

24/7 Global Markets: Unlike traditional markets with limited trading hours, blockchain-based tokens can be traded around the clock, across borders, without intermediaries.

Transparency and Security: Blockchain provides an immutable record of ownership and transactions. Smart contracts automate processes and reduce the potential for fraud or disputes.

Reduced Costs: By eliminating intermediaries and automating processes through smart contracts, tokenization significantly reduces transaction costs, management fees, and administrative overhead.

Programmability: Smart contracts can encode complex rules, such as automatic dividend payments, compliance checks, or governance rights, making asset management more efficient.

Real-World Applications and Market Growth

The tokenization market is experiencing explosive growth. According to McKinsey, the tokenized asset market could reach $2 trillion by 2030, excluding cryptocurrencies [2]. Major financial institutions including BlackRock, JPMorgan, and Franklin Templeton are actively launching tokenized funds and exploring blockchain-based securities.

Real estate remains the leading sector, but we are seeing expansion into:

•Art and Collectibles: Platforms like Masterworks tokenize fine art, allowing investors to own shares in paintings worth millions.

•Private Equity and Venture Capital: Fund managers are tokenizing stakes in startups and private companies.

•Commodities: Gold, silver, and agricultural products are being tokenized for easier trading and storage.

•Intellectual Property: Music royalties, patents, and licensing rights are being converted into tradeable tokens.

Challenges and Considerations

Despite its promise, tokenization faces several challenges:

Regulatory Uncertainty: Different jurisdictions have varying rules about digital securities. Issuers must navigate complex compliance requirements across multiple countries.

Legal Framework: The legal enforceability of token ownership rights is still evolving. Clear legal structures are essential to protect investors.

Technology Risks: Smart contract bugs, blockchain vulnerabilities, and platform security issues pose risks that must be carefully managed.

Market Adoption: Widespread adoption requires education, user-friendly platforms, and integration with traditional financial systems.

The Future of Tokenization

The tokenization process represents a fundamental shift in how we think about ownership and investment. As regulatory frameworks mature, technology improves, and institutional adoption increases, we can expect tokenization to become the standard method for issuing and trading securities.

The journey from a physical property, diamond, or commodity to a digital token accessible on a smartphone represents more than technological innovation—it represents the democratization of finance. By breaking down barriers to entry, increasing liquidity, and enhancing transparency, tokenization is creating a more inclusive and efficient global financial system.

Whether you are an investor seeking new opportunities, an asset owner looking to unlock value, or simply someone interested in the future of finance, understanding the tokenization process is essential. As this diagram illustrates, the path from real-world asset to digital token is becoming increasingly streamlined, opening doors to a new era of accessible, transparent, and efficient investing.

Traditional Ownership vs. Tokenization – The Future of Property Investment