The World's Hidden Treasures: A 2025 Report on Unmined Gold Reserves

Introduction

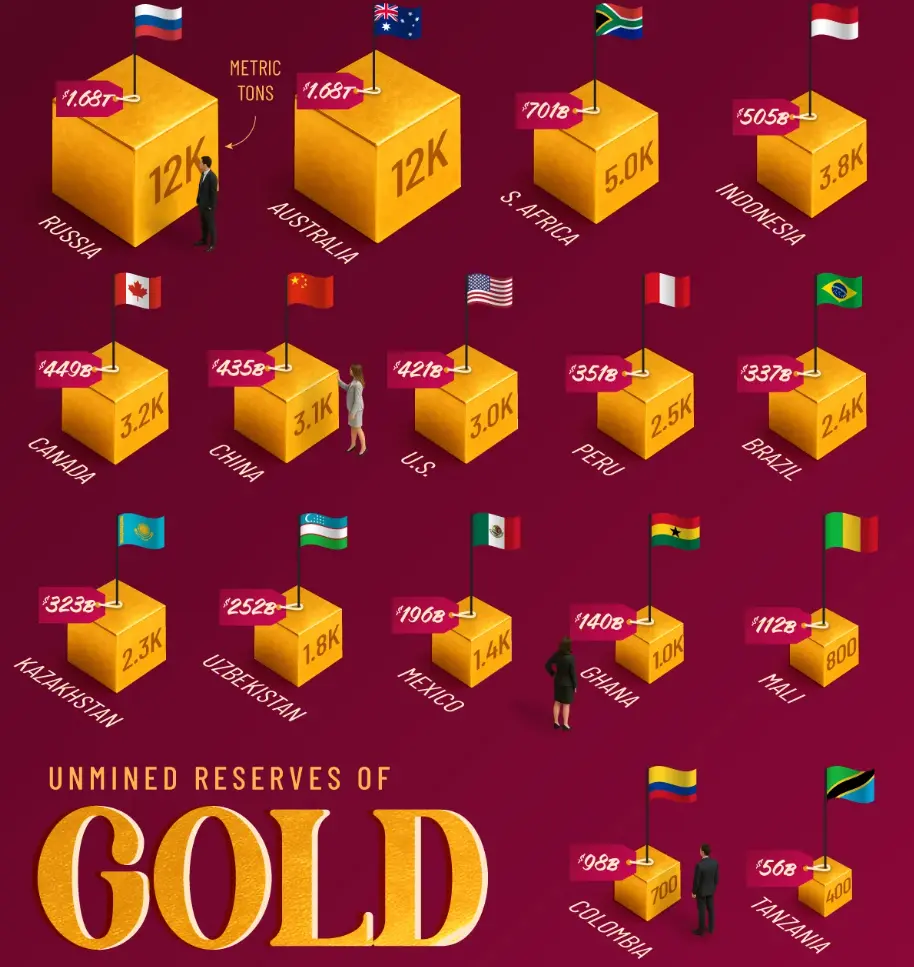

While central banks are actively accumulating gold, another critical aspect of the global gold story lies deep within the Earth's crust. The world's unmined gold reserves represent the future of gold production and hold immense economic and geopolitical significance. This report, based on January 2025 data from the U.S. Geological Survey as presented by Visual Capitalist, provides a comprehensive ranking of countries by their economically recoverable gold deposits 1. With gold prices trading above $4,000 per troy ounce, these untapped reserves, valued at over $7 trillion, highlight where the next phase of global gold production will be concentrated.

The Titans of Unmined Gold: Russia and Australia

Russia and Australia stand as the undisputed leaders in unmined gold reserves, each holding an estimated 12,000 tonnes. Together, they account for nearly 40% of the world's total unmined gold, with each country's reserves valued at approximately $1.7 trillion. This immense underground wealth positions them as key players in the future of the global gold market 1.

Russia's vast gold deposits are primarily located in the remote and resource-rich regions of Siberia and the Far East. In Australia, the majority of untapped gold is found in Western Australia, particularly within the prolific Yilgarn Craton, a region known for hosting some of the world's largest gold deposits 1.

The following table provides a detailed ranking of countries by their unmined gold reserves as of 2025:

Source: U.S. Geological Survey, January 2025 1

Emerging Markets and the Future of Gold Exploration

Beyond the established leaders, emerging markets are poised to play an increasingly important role in the future of gold production. Indonesia, with 3,800 tonnes of unmined gold, ranks fourth globally, while Peru and Brazil also hold significant reserves. These countries are likely to attract substantial investment as the global demand for gold continues and the search for lower-cost extraction opportunities intensifies 1.

Africa is also emerging as a key frontier for gold exploration. While South Africa leads the continent with 5,000 tonnes of unmined reserves, countries like Ghana, Mali, and Tanzania are also attracting significant attention from the mining industry. The concentration of unmined gold in these regions suggests a potential shift in the geographic focus of gold production in the coming decades 1.

Conclusion

The distribution of unmined gold reserves offers a glimpse into the future of the global gold market. The dominance of Russia and Australia, combined with the significant potential of emerging markets in Asia, South America, and Africa, highlights the dynamic and evolving nature of gold production. As the world's appetite for gold continues, these untapped reserves will become increasingly critical, shaping the economic fortunes of nations and influencing the geopolitical landscape for years to come.

SiniSa Dagary, www.sinisadagary.com