Blockchain Explained: The Trust Machine Powering the Next Generation of Finance

Blockchain is one of the most transformative technologies of the 21st century, yet it remains widely misunderstood. Often used interchangeably with Bitcoin, the reality is that Bitcoin was merely the first major application of blockchain technology. The technology itself is far more profound: it is a new architecture for trust, a revolutionary way of recording and verifying information that is poised to overhaul industries far beyond finance.

At its core, a blockchain is a decentralized, distributed, and immutable digital ledger. Think of it as a shared digital record book, but one that isn't stored in a single location or controlled by a single entity. Instead, it is copied and spread across a vast network of computers, making it incredibly resilient and transparent. Once a record is added, it is permanent and cannot be altered, creating an unchangeable history of transactions.

This simple but powerful concept solves a problem that has existed for centuries: the need for a trusted third party. In our current system, trust is expensive and inefficient. Banks, credit card companies, governments, and lawyers act as intermediaries, and while they provide a vital service, they also introduce bottlenecks, fees, and single points of failure. Data can be lost, manipulated, or siloed within these centralized organizations. Blockchain technology automates this trust by distributing it across a network, allowing parties to interact and transact directly with one another in a secure, verifiable, and transparent manner. It is this ability to create a single source of truth without a central authority that makes blockchain the foundational engine for everything from cryptocurrencies to the tokenization of real-world assets.

This guide will demystify blockchain technology. We will break down its core components, explore the different types of blockchains, and look at how this "trust machine" is being used to build a more efficient, transparent, and accessible global economy.

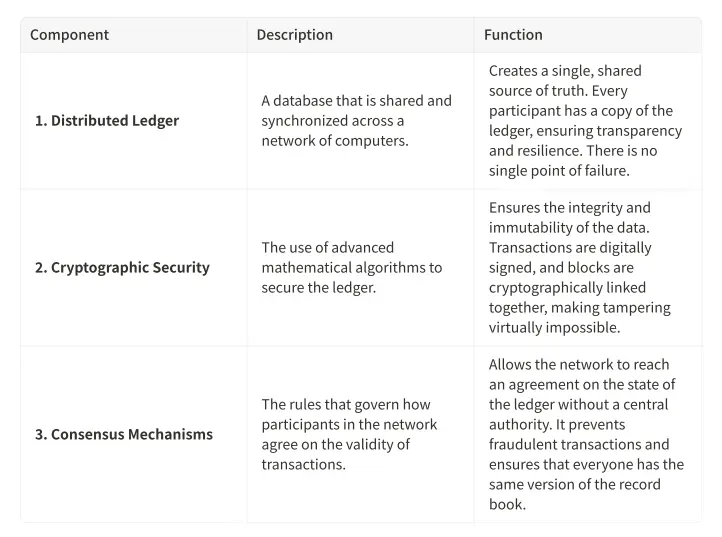

The Architecture of Trust: Core Components of a Blockchain

To understand how blockchain creates trust, it is essential to understand its three core components: the distributed ledger, cryptographic security, and consensus mechanisms.

How a Transaction is Added to the Blockchain

1.Initiation: A transaction is initiated (e.g., sending money, recording data).

2.Broadcasting: The transaction is broadcast to a network of computers (nodes).

3.Validation: The network of nodes validates the transaction using a consensus mechanism.

4.Block Creation: Once validated, the transaction is grouped with other transactions into a "block."

5.Chaining: The new block is cryptographically linked to the previous block, creating a permanent and unchangeable chain.

6.Distribution: The updated ledger is distributed to all participants in the network.

This process ensures that every transaction is secure, transparent, and irreversible. The result is a ledger with unprecedented integrity. Because every participant holds a copy of the ledger, there is no single version that can be secretly altered. This creates a level of trust that is not based on the reputation of an institution, but on the mathematical certainty of the code itself.

The Blockchain Spectrum: From Public to Private

Not all blockchains are created equal. The technology can be deployed in different ways to suit different needs, creating a spectrum from fully open public networks to highly controlled private systems.

•Public Blockchains: These are the most well-known type, characterized by their open and permissionless nature. Anyone can join the network, participate in the consensus process, and view the ledger. Public blockchains are highly decentralized and censorship-resistant, making them ideal for applications like cryptocurrencies (e.g., Bitcoin, Ethereum). However, their openness can lead to slower transaction speeds and challenges with scalability.

•Private Blockchains: These are permissioned networks that are controlled by a single organization. Participation is restricted to a select group of pre-approved entities. Private blockchains offer high speed, scalability, and privacy, as the controlling entity can determine who has access to what data. They are often used by enterprises for internal processes, such as supply chain management or inter-company settlements. While efficient, they sacrifice the core benefit of decentralization and are essentially highly secure, distributed databases rather than true, trustless systems. However, for many enterprise use cases where regulatory compliance and control are paramount, this trade-off is necessary and desirable.

•Consortium (or Hybrid) Blockchains: These represent a middle ground between public and private blockchains. They are governed by a group of organizations rather than a single entity. This model is ideal for collaboration between multiple companies in the same industry (e.g., a group of banks sharing a settlement ledger). Consortium blockchains offer a balance of decentralization, speed, and security, making them a popular choice for enterprise applications. The Hyperledger fabric, used by Slaff.io, is a prime example of a consortium blockchain framework designed for business.

Beyond the Ledger: Smart Contracts and Tokenization

The true power of blockchain technology was unlocked with the advent of smart contracts. A smart contract is a self-executing contract with the terms of the agreement directly written into code. They run on the blockchain and automatically execute when predetermined conditions are met, without the need for intermediaries.

Think of a smart contract as a digital vending machine. You insert your money (input), and the machine automatically dispenses your chosen snack (output). Smart contracts do the same for complex transactions. They can automate everything from insurance payouts (e.g., a flight insurance policy that automatically pays out if a flight is delayed, based on a trusted data feed) and royalty distributions for artists to the execution of complex financial agreements like derivatives or escrow services.

This programmability is what enables tokenization, the process of creating a digital representation of an asset on a blockchain. By using smart contracts, we can create digital tokens that represent ownership of virtually any asset, whether physical or digital.

•Real Estate: A commercial building can be tokenized, allowing investors to buy and sell fractional ownership in the property.

•Private Equity: A startup can tokenize its shares, creating a liquid market for early-stage investors.

•Art and Collectibles: A famous painting can be divided into thousands of digital tokens, democratizing access to high-value art.

Tokenization, powered by blockchain and smart contracts, is creating a new financial infrastructure that is more liquid, accessible, and efficient than ever before. Platforms like Slaff.io leverage this technology to offer investors access to a wide range of tokenized assets, from real estate funds to private company shares, all within a secure and regulated environment.

Conclusion: The Unseen Engine of the Digital Economy

Blockchain technology has evolved far beyond its origins as the foundation for Bitcoin. It has become the unseen engine of a new digital economy, a fundamental tool for creating trust, verifying ownership, and enabling secure transactions in a digital world. From powering global cryptocurrencies to tokenizing the world's most valuable assets, blockchain is rebuilding our financial infrastructure from the ground up.

While the technology is complex, its core value proposition is simple: it provides a way to create a single, shared source of truth that is not controlled by any single entity. This seemingly straightforward innovation has profound implications, paving the way for a future that is more decentralized, transparent, and efficient. As blockchain continues to mature and integrate into our daily lives, its applications will become as ubiquitous and invisible as the internet protocols we rely on today. Understanding its fundamental principles is no longer optional for those in finance and technology—it is essential for navigating the next wave of digital transformation.