Beyond Bitcoin: How to Build a Diversified Investment Portfolio with Digital Assets

For years, Bitcoin has been the undisputed king of the digital asset world, serving as the primary entry point for millions of new investors. Its journey from a niche technological experiment to a globally recognized store of value has been nothing short of revolutionary. However, as the market matures and institutional adoption accelerates, the conversation is shifting. The era of simply buying and holding Bitcoin is evolving into a more sophisticated approach centered on a core principle of traditional finance: diversification.

If you are serious about long-term wealth creation in the digital economy, relying solely on a single asset, no matter how promising, exposes your portfolio to unnecessary risk. The digital asset ecosystem has exploded in complexity and opportunity, offering a rich tapestry of investment possibilities that extend far beyond its famous progenitor. From smart contract platforms and decentralized finance (DeFi) protocols to the groundbreaking tokenization of real-world assets (RWAs), a new universe of value is waiting to be unlocked.

This guide is designed for the investor who is ready to move beyond a Bitcoin-only strategy. We will explore why diversification is critical in the volatile crypto market, break down the essential components of a modern digital asset portfolio, and provide a strategic framework for allocating your capital based on your risk tolerance. Welcome to the next phase of your investment journey.

The Investor’s Shield: Why Diversification is Non-Negotiable

The crypto market is known for its exhilarating highs and gut-wrenching lows. While this volatility can lead to spectacular gains, it can also result in devastating losses. Diversification is the most effective strategy to manage this inherent risk. By spreading your investments across various assets that are not perfectly correlated, you can cushion your portfolio against the poor performance of any single asset.

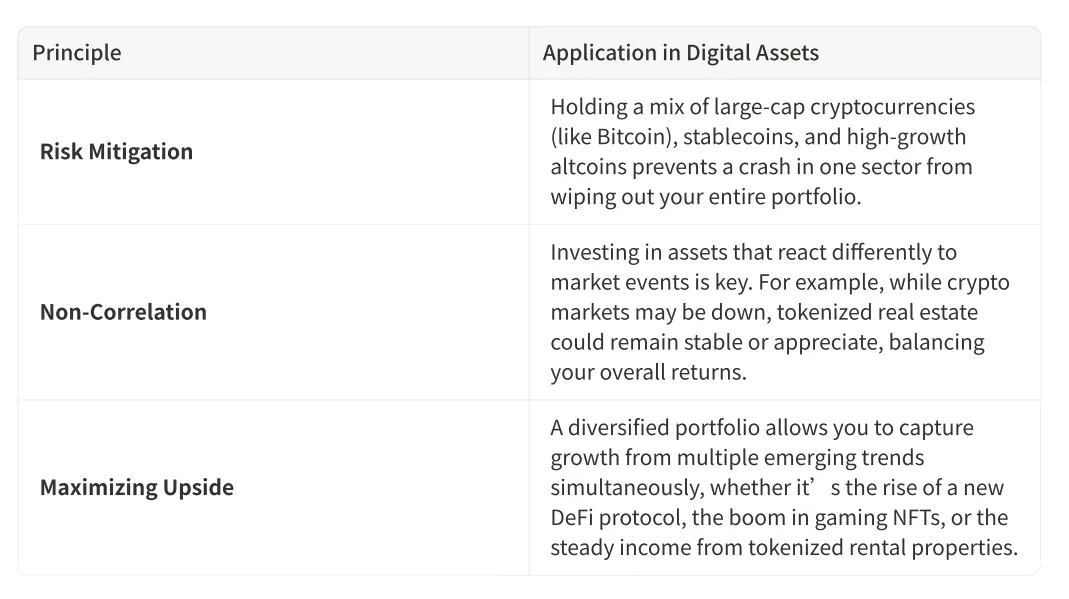

The core principles of diversification are timeless, but they take on special significance in the digital asset space:

In essence, diversification transforms you from a speculator betting on a single outcome into a strategic investor building a resilient, all-weather portfolio. It’s the difference between gambling and investing.

The Anatomy of a Modern Digital Asset Portfolio

Building a diversified portfolio requires understanding the different types of digital assets and the unique role each plays. A well-structured portfolio can be visualized as a series of layers, each with a distinct purpose, risk profile, and growth potential.

Layer 1: The Foundation – Blue-Chip Cryptocurrencies

This layer forms the bedrock of your portfolio and should consist of the most established, liquid, and widely adopted cryptocurrencies. For most investors, this means Bitcoin (BTC) and Ethereum (ETH).

•Bitcoin (BTC): Often referred to as "digital gold," Bitcoin’s primary value proposition is its status as a decentralized, censorship-resistant store of value. Its fixed supply and robust network security make it an attractive hedge against inflation and geopolitical instability. It provides stability and long-term growth potential to your portfolio.

•Ethereum (ETH): If Bitcoin is digital gold, Ethereum is the decentralized world computer. It is the dominant smart contract platform, powering a vast ecosystem of decentralized applications (dApps), including DeFi, NFTs, and more. Holding ETH is a bet on the continued growth of this entire ecosystem.

Allocation: A significant portion of your crypto portfolio (e.g., 40-60%) should typically be allocated to this foundational layer, providing a stable base.

Layer 2: The Growth Engine – Promising Altcoins & Sectors

Once your foundation is secure, the next layer is dedicated to growth. This involves investing in high-quality "altcoins" (any cryptocurrency other than Bitcoin) that have strong fundamentals, clear use cases, and significant growth potential. Rather than picking coins at random, a strategic approach is to invest in key sectors that are poised to shape the future of the digital economy.

•Layer-1 & Layer-2 Solutions: These are alternative blockchain protocols (e.g., Solana, Avalanche) or scaling solutions (e.g., Polygon, Arbitrum) that aim to improve upon Ethereum's speed, cost, or scalability. Investing here is a bet on a multi-chain future where different blockchains coexist.

•Decentralized Finance (DeFi): This sector aims to rebuild the entire financial system—lending, borrowing, and trading—on the blockchain. Investing in leading DeFi protocols (e.g., Uniswap, Aave) can provide both governance rights and a share in the protocol's revenue.

•Other Promising Sectors: Depending on your interests, this could include decentralized storage (e.g., Filecoin), blockchain oracles (e.g., Chainlink), or digital identity solutions.

Allocation: This growth-oriented layer might comprise 20-30% of your portfolio. It carries more risk than the foundational layer but offers significantly higher potential returns.

Layer 3: The Stabilizer – Tokenized Real-World Assets (RWAs) & Stablecoins

This is perhaps the most revolutionary and important layer for building a truly resilient portfolio. While cryptocurrencies are powerful, their prices are often correlated, meaning they tend to move up and down together. To achieve true diversification, you need to include assets whose value is derived from outside the crypto ecosystem. This is where tokenized Real-World Assets (RWAs) and stablecoins come in.

•Tokenized Real-World Assets (RWAs): This involves converting ownership of tangible assets, like real estate or private equity, into digital tokens on a blockchain. Investing in RWAs offers several powerful benefits:

•Non-Correlation: The value of a tokenized apartment building is tied to the real estate market and rental income, not crypto market sentiment.

•Passive Income: Many tokenized assets, particularly real estate, generate steady, predictable cash flow in the form of rental dividends.

•Accessibility: It allows you to gain fractional ownership in lucrative asset classes that were previously inaccessible to retail investors.

•Stablecoins: These are cryptocurrencies pegged to a stable asset, usually the US dollar (e.g., USDT, USDC). Holding a portion of your portfolio in stablecoins serves two critical functions:

•Defense: During market downturns, you can move funds into stablecoins to preserve capital.

•Liquidity: They provide the "dry powder" needed to buy assets quickly when investment opportunities arise.

Allocation: This stabilizing layer could make up 15-25% of your portfolio, providing a crucial buffer against volatility and a source of passive income.

Layer 4: The Exploration Zone – High-Risk, High-Reward Ventures

Finally, the smallest and most speculative portion of your portfolio can be dedicated to exploration. This is where you can take calculated risks on emerging trends and technologies that have the potential for exponential growth, but also a high probability of failure. This layer is not for the faint of heart and should only contain capital you are fully prepared to lose.

•NFTs & Digital Collectibles: While the initial hype has cooled, the market for non-fungible tokens (NFTs) continues to mature, with applications in art, gaming, and digital identity.

•Micro-Cap Projects: These are new, low-market-cap cryptocurrencies that are highly speculative but could deliver outsized returns if they gain traction.

•Angel Investing: Some platforms allow you to invest directly in early-stage blockchain startups, offering ground-floor access to the next wave of innovation.

Allocation: This speculative layer should represent a very small fraction of your total portfolio, typically no more than 5-10%.

Putting It All Together: Allocation Strategies for Every Investor

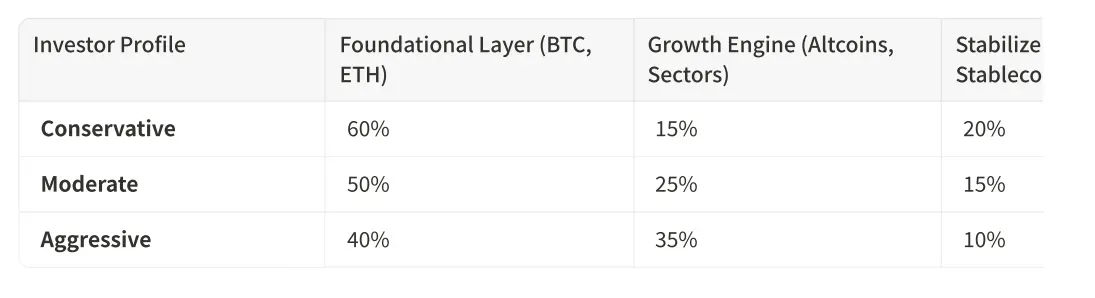

There is no one-size-fits-all portfolio. Your ideal asset allocation will depend on your age, financial goals, and personal risk tolerance. Below are three sample allocation models to use as a starting point.

A Conservative investor prioritizes capital preservation and is focused on steady, long-term growth. Their portfolio is heavily weighted towards established blue-chip assets and stabilizers. An Aggressive investor, in contrast, is willing to take on significant risk in pursuit of higher returns and allocates a larger portion to the growth and exploration layers. The Moderate investor strikes a balance between the two, seeking a mix of growth and stability.

The Art of Rebalancing: Maintaining Your Strategic Edge

Once you have established your target allocation, the work isn’t over. Over time, as different assets grow at different rates, your portfolio will drift away from its intended balance. For example, a bull run in the altcoin market could cause your “Growth Engine” layer to swell from 25% of your portfolio to 40%, making you overexposed to risk.

Rebalancing is the process of periodically buying and selling assets to return your portfolio to its original target allocation. This disciplined practice forces you to adhere to the classic investment wisdom of “buy low, sell high.” By trimming the assets that have performed well and re-investing the profits into underperforming assets, you systematically lock in gains and manage risk.

Most experts recommend rebalancing on a set schedule (e.g., quarterly or semi-annually) or whenever your allocations drift by a certain percentage (e.g., 5%). This removes emotion from the decision-making process and ensures your portfolio remains aligned with your long-term strategy.

Choosing Your Gateway: The Importance of a Secure, Multi-Asset Platform

Executing a sophisticated diversification strategy is only possible if you have the right tools. Juggling multiple exchanges, wallets, and platforms to manage different asset classes is not only cumbersome but also a security risk. A modern digital finance platform should serve as a unified gateway to the entire digital asset ecosystem.

When selecting a platform, prioritize one that offers:

•Multi-Asset Support: The ability to hold and trade everything from Bitcoin and Ethereum to tokenized real estate and stablecoins in a single, integrated wallet.

•Institutional-Grade Security: Look for platforms built on enterprise-grade blockchains like Hyperledger that offer robust security features and significant insurance coverage on assets.

•Regulatory Compliance: A strong commitment to KYC and AML regulations is a sign of a trustworthy and sustainable platform.

Conclusion: The Future is a Diversified Portfolio

The digital asset market has matured far beyond its speculative origins. As we move further into 2025, the winning strategy will not be about finding the next 100x memecoin, but about building a resilient, diversified portfolio that can withstand market cycles and capture value across a wide spectrum of opportunities.

By layering your portfolio with a foundation of blue-chip cryptocurrencies, a growth engine of promising altcoins, a stabilizing force of tokenized real-world assets, and a small allocation for exploration, you can move beyond the simple act of buying Bitcoin. You can become a strategic investor, thoughtfully constructing a financial future that is both robust and full of potential. The tools and the assets are here. It’s time to build.